Utah Fundraising Licensing

Below, you'll find licensing requirements for a range of fundraising activities. At a glance, you can see requirements, fees, filing instructions, and links to forms for everything from charitable gaming and cause marketing to professional fundraisers and charitable gift annuities.

Make sure your fundraising activities meet the unique requirements of each jurisdiction where you’re soliciting. Feel free to explore, bookmark, and share!

- Jump To:

- Utah Nonprofit & Fundraising Company Licenses

- Utah Individual Nonprofit & Fundraising Licenses

Company Licenses

Utah Nonprofit & Fundraising Company Licenses

Utah Charitable Gaming License

Not required

Charitable Gaming licensure is not required on the State level in Utah.

Utah statutes do not currently provide for any charitable gaming activites.

Utah Charitable Gift Annuity Registration

Not required

Charitable Gift Annuity licensure is not required on the State level in Utah.

No filing is required. Utah generally exempts charitable organizations from insurance regulation related to charitable gift annuities.

| Law: | UT Code § 31A-22-1303 |

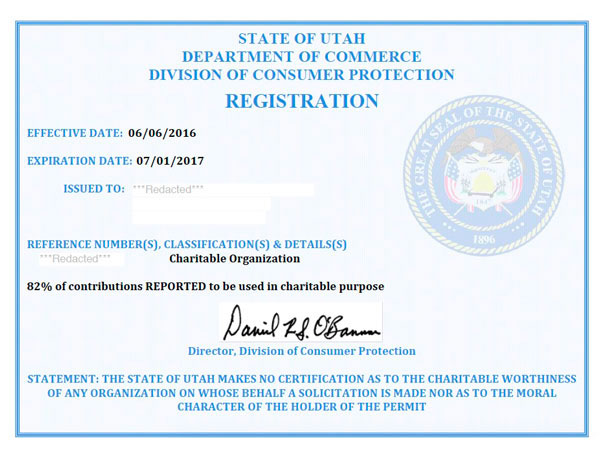

Utah Charitable Registration License

Not required

Charitable Registration licensure is not required on the State level in Utah.

The Division of Consumer Protection no longer issues charitable registrations. New filing requirements for charitable organizations will be administered by the Division of Corporations and Commercial Code.

More information: Utah Department of Commerce - Division of Consumer Protection| Law: | Utah Code Annotated § 13-22-1 - § 13-22-23; Utah Administrative Code, Rule R152-22-1 through R152-22-7 |

Utah Commercial Co-Venturer Registration

Not required

Commercial Co-venturer licensure is not required on the State level in Utah.

Utah does not currently have a traditional registration requirement for commercial co-venturers, but they may need to follow other regulations before and after fundraising events.

"Professional fund raising counsel or consultant" means a person who:(i)

for compensation or any other consideration, plans, manages, counsels, consults, or prepares material for, or with respect to, the solicitation of contributions for a charitable organization or any other person;

(ii)

does not solicit contributions;

(iii)

does not at any time have custody of a contribution from solicitation; and

(iv)

does not employ, procure, or engage any compensated person to solicit or receive contributions.

(b)

"Professional fund raising counsel or consultant" does not include:(i)

an individual acting in the individual's capacity as a bona fide officer, director, volunteer, or full-time employee of a charitable organization;

(ii)

an attorney, investment counselor, or banker who, in the conduct of that person's profession, advises a client regarding legal, investment, or financial advice; or

(iii)

a person who tangentially prepares materials, including a person who:(A)

makes copies;

(B)

cuts or folds flyers; or

(C)

creates a graphic design or other artwork without providing strategic or campaign-related input.

Utah Fundraising Counsel Registration

| Agency: | Utah Department of Commerce - Division of Consumer Protection |

| Registered Agent (Special Agency) Required? | Yes |

Initial Registration

| Filing Method: | |

| Agency Fee: | $500 |

Registration Renewal

| Filing Method: | |

| Agency Fee: | $500 |

| Due: | Annually by the registration anniversary date. |

Contract Filing

| Agency Fee: | $0 |

| Due: | Prior to commencement of each solicitation campaign each professional fund raiser, fund raising counsel or consultant or charitable organization shall notify the Division in writing at least 10 days in advance of its intent to commence a campaign. |

Amendment

| Agency Fee: | $0 |

| Due: | If any information contained in the application for a permit becomes incorrect or incomplete, the applicant or registrant shall, within 30 days after the information becomes incorrect or incomplete, correct the application or file the complete information required by the division. |

A professional fund raiser is defined by the Charitable Solicitations Act to mean a person who:

- for compensation or any other consideration, for or on behalf of a charitable organization or any other person:

- solicits contributions; or

- promotes or sponsors the solicitation of contributions;

- For compensation or any other consideration, plans, manages, counsels, consults, or prepares material for, or with respect to, the solicitation of contributions for a charitable organization or any other person; and

- at any time has custody of a contribution for the charitable organization;

- engages in, or represents being independently engaged in, the business of soliciting contributions for a charitable organization;

- manages, supervises, or trains any solicitor whether as an employee or otherwise; or

- uses a vending device or vending device decal for financial or other consideration that implies a solicitation of contributions or donations for any charitable organization or charitable purposes.

"Professional fund raiser" does not include:

- an individual acting in the individual's capacity as a bona fide officer, director, volunteer, or full-time employee of a charitable organization;

- an attorney, investment counselor, or banker who, in the conduct of that person's profession, advises a client regarding legal, investment, or financial advice; or

- a person who tangentially prepares materials, including a person who:

- makes copies;

- cuts or folds flyers; or

- creates a graphic design or other artwork without providing strategic or campaign-related input.

Utah Professional Fundraiser Registration

| Agency: | Utah Department of Commerce - Division of Consumer Protection |

Initial Registration

| Filing Method: | |

| Agency Fee: | $500 |

| Original Ink: | Not Required |

| Notarization Required?: | Not Required |

| Notes: | All contract agreements with each charitable organization using the applicant’s services, and a copy of all agreements to which the applicant is, or proposes to be, a party regarding the use of proceeds must be included with the application. |

| Before you Apply: |

|

| Required Attachments: |

|

Registration Renewal

| Filing Method: | |

| Agency Fee: | $500 |

| Due: | Annually by the registration anniversary date. |

| Original Ink: | Not Required |

| Notarization Required?: | Not Required |

| Notes: | All contract agreements with each charitable organization using the applicant’s services, and a copy of all agreements to which the applicant is, or proposes to be, a party regarding the use of proceeds must be included with the application. |

Contract Filing

| Agency Fee: | $0 |

| Due: |

|

Financial Reporting

| Agency Fee: | $0 |

| Due: | No later than 90 days after the day in which a fundraising campaign ends, a professional fundraiser shall submit a financial report to the division detailing:

|

| Law: |

Amendment

| Agency Fee: | $0 |

| Due: | If any information contained in the application for a permit becomes incorrect or incomplete, the applicant or registrant shall, within 30 days after the information becomes incorrect or incomplete, correct the application or file the complete information required by the division. |

Individual Licenses

Utah Individual Nonprofit & Fundraising Licenses

Utah Individual Professional Fundraiser Registration

Not required

Professional Solicitor licensure is not required on the State level in Utah.

Solicitors who are not employed by a professional fundraising firm but operate independently may be required to register. Employees of professional fundraising firms are generally not required to register as an individual solicitor in Utah.