Annual Reports

Stay Compliant With Managed Annual Report Service

- Save time! Maintain a single online company profile that we use to file annual reports nationwide.

- Ensure on-time filing. Our software tracks due dates and files reports on time to maintain good standing and avoid late fees.

- Enjoy total visibility. See due dates, filing status, approved documents, and more.

Annual fees are $199 per state plus filing fees.

Command the Annual Report Cycle

Annual report compliance requires expertise and attention throughout the year. Our Managed Annual Report Service provides timely and accurate annual report filing, saving you time and ensuring good standing.

Place your annual reports in expert hands and get back to business.

Managed Annual Report Service automates every aspect of multistate annual report preparation and filing. The result is unparalleled efficiency and time savings.

Simply enter and maintain your company data in our secure web-based Information Form. Our software directly integrates with secretary of state databases and filing portals. We file annual reports automatically in all states as they come due.

We Pick Up Where You Leave Off

No matter how many entities you have and where they are registered, we make it easy to hand off management of your annual reports to us.

You securely provide company information.

We import registration data and research entity statuses.

We ensure accurate due date tracking and on-time filing.

Pricing

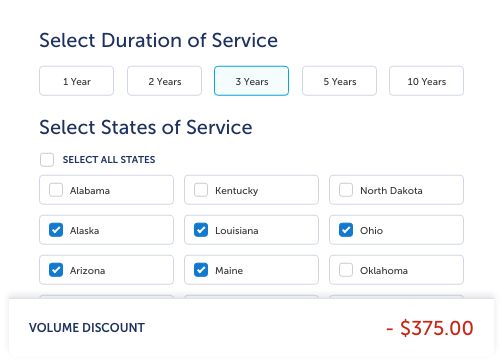

Annual service fees are $199 per state. Volume discounts up to 40% are available when you order online.

Filing fees are invoiced prior to your report deadlines.

Get hassle-free annual report compliance and achieve cost savings with our online ordering tool.

To speak with an annual report expert, contact us.

They walked us through the whole process step by step and remained in constant communication throughout. The level of service provided by our Account Manager and Compliance Specialist was beyond EXCELLENT. They were prompt, courteous, knowledgeable, and detailed… a truly STRESS FREE experience. You will not regret hiring Harbor Compliance!

Stephanie Loudoun Insurance Group, LLC