Start a 501(c) Nonprofit

Leave Registering Your Nonprofit to the Experts

We actually prepare your state and IRS applications and file for you.

Services from $2,499 plus filing fees.

Harbor Compliance has partnered with BryteBridge Nonprofit Solutions. Since 2004, BryteBridge has helped over 45,000 nonprofits nationwide!

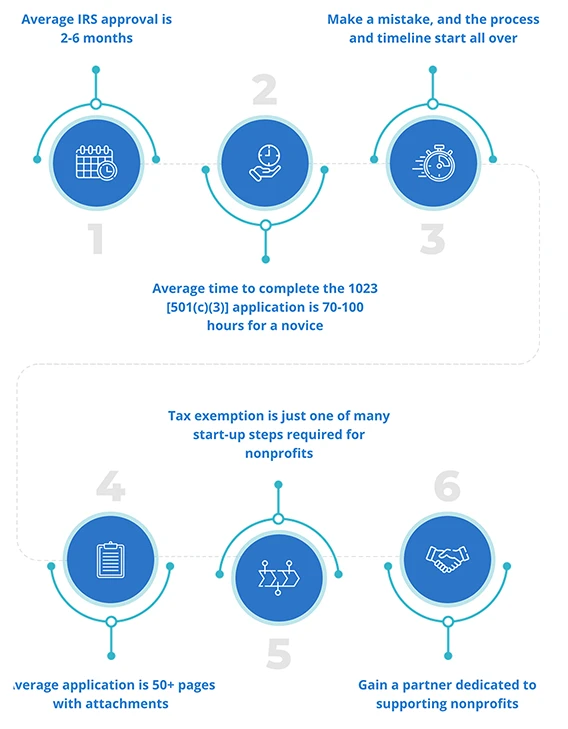

Use a Professional and Avoid Costly Mistakes

Using a professional can help expedite the process of starting a nonprofit, by eliminating mistakes.

Why Do Nonprofit Startups Choose BryteBridge?

When you partner with BryteBridge Nonprofit Solutions, you’re not just getting help with paperwork—you’re getting everything your nonprofit needs, bundled into one seamless package.

We’ll walk you through and help you navigate all regulatory and operational hoops, including:

- Incorporate your Nonprofit: Complete articles of incorporation for your nonprofit startup.

- Craft Bylaws and Conflict of Interest Policy

- EIN: Obtain your employee identification number (EIN) via the IRS Form SS4.

- Tax Exempt Status: Obtain proper nonprofit designation (501(c)(3), other 501(c) types, etc.) with tax-exempt status.

- State Compliance: File for your state's specific formation requirements.

- Worry-Free Compliance: BryteBridge Connect provides ongoing support, education, and compliance automatically so you can focus on your organization's mission.

- And so much more!

Nonprofit Startup Pricing

Our comprehensive 501(c)(3) services include everything you need to incorporate, obtain 501(c)(3) status, and meet initial state nonprofit operating requirements. We believe that starting your nonprofit shouldn't break the budget, either.

Have questions? Give us a call

| Essentials | Connect + Concierge Formation |

Connect + Concierge + Nationwide Fundraising |

|---|---|---|

|

Essentials

$2,499 |

Connect + Concierge

Formation

$3,499 |

Connect + Concierge +

Nationwide Fundraising

Talk To Us |

$2,499 |

$3,499 |

Talk To Us |

Compare Features

|

Essentials

|

Connect + Concierge Formation |

Connect + Concierge + Nationwide Fundraising

|

|

|---|---|---|---|

| 501(c)(3) Approval Guarantee |

Essentials:

Included

|

Connect + Concierge Formation:

Included

|

Connect + Concierge Formation

+ Nationwide Fundraising:

Included

|

State Formation

|

Essentials:

Included

|

Connect + Concierge Formation:

Included

|

Connect + Concierge Formation

+ Nationwide Fundraising:

Included

|

IRS Setup

|

Essentials:

Included

|

Connect + Concierge Formation:

Included

|

Connect + Concierge Formation

+ Nationwide Fundraising:

Included

|

BryteBridge Connect Membership

|

6 Months

Essentials:

6 Months

|

12 Months

Connect + Concierge Formation:

12 Months

|

12 Months

Connect + Concierge Formation

+ Nationwide Fundraising:

12 Months

|

MoneyMinder Accounting Software

|

12 Months

Connect + Concierge Formation:

12 Months

|

12 Months

Connect + Concierge Formation

+ Nationwide Fundraising:

12 Months

|

|

Nationwide Fundraising Compliance

|

Connect + Concierge Formation

+ Nationwide Fundraising:

Included

|

Frequently Asked Questions

Preparing the regulatory paperwork required to create a 501(c)(3) charitable organization can be daunting. In addition, you may be required to file incorporation documents with your state and municipality. The average application package is typically between 50 and 100 pages of questions, supporting information, and required documents and can take upwards of 70 to 100 hours to complete. A single mistake can add weeks or even months to obtaining IRS approval!

With BryteBridge Nonprofit Solutions, you gain an experienced, trusted partner who has experience preparing all IRS, federal, and state documents and can help expedite the approval process. We are here for you every step of the way.

We have helped over 45,000 nonprofit startups since 2004 (and that number grows every week). Our clients come from all over the United States and represent various community programs. In addition, our research and knowledge of grants for nonprofit startups have helped many organizations to survive and thrive over our 18 years in business. Check out what people are saying on Google!

Helping nonprofits is our passion! In addition to our fee-based services, we also provide many free tools, white papers, articles, and resources that can help you launch and grow a charitable organization. For example , we offer a nonprofit startup guide, a state compliance regulations map, a grants readiness evaluation, an educational blog, grants for nonprofit startups 101 to give you an overview of how funding works, and so much more!

Absolutely! We offer a Spanish-language version of our website and materials to meet the needs of our Spanish-speaking communities! Simply click here!

Learn More

Our nonprofit resources make it easy to ensure that you’ve covered all the regulatory bases. For more resources, make sure to visit our Information Center