Easily Obtain Your Federal EIN

Our EIN service provides you with the federal tax ID you need to open a bank account, file tax returns, or hire employees. Convenient web-based ordering makes the process quick and painless.

Don't waste time filling out government forms or interacting with automated phone systems. We provide a quick, secure, and hassle-free process for obtaining your EIN.

Ultimate Convenience

-

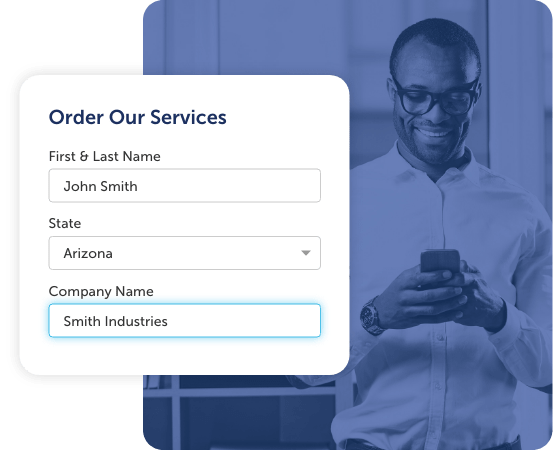

Instant Online Ordering

We make it easy to secure your EIN. Simply provide your information in our convenient online form, and we’ll take care of the rest. -

Time Savings

The IRS estimates that filing Form SS-4 to apply for an EIN takes 1.5 hours. Ordering our service takes just a few minutes.

The Best Protection

-

Private and Secure Service

Your social security number and EIN are sensitive data, and we take the security of your information seriously. All of our specialists are trained in Payment Card Industry Data Security Standards. -

Comprehensive Support

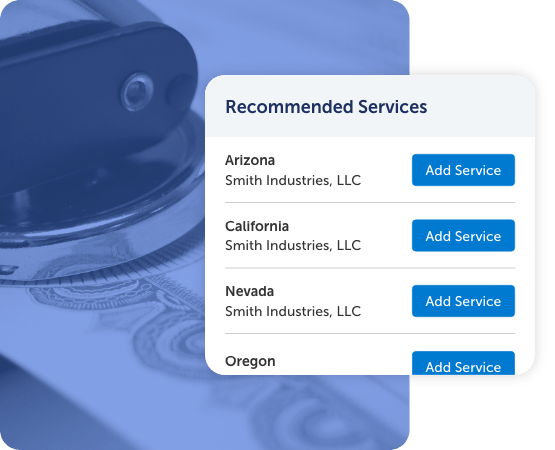

We can help you with any additional tax registrations or business licenses you may need. Our compliance services are a perfect fit for companies that plan to hire employees, sell physical goods, or open offices in other states. -

Proceed With Confidence

Harness the expertise of our filing experts through Compliance Gaps. As soon as your account with us is configured, Compliance Gaps suggests regulatory filings commonly required of companies like yours in the states where you operate.

How Our EIN Service Works

Complete the online form to order our EIN service. Once we have submitted your filings, we will track their progress and send confirmation when they are approved.

Securing Your EIN

We prepare and submit your IRS Form SS-4.

Receive your approved EIN.

Frequently Asked Questions

An Employer Identification Number (EIN) is a unique nine-digit identification code issued by the Internal Revenue Service (IRS) to a business. An EIN follows the format 12-3456789. It is like the Social Security Number for your business, used for filing tax returns, opening a bank account, and hiring employees.

All businesses except sole proprietors without employees need an EIN. Sole proprietors may wish to obtain an EIN to avoid using their SSN.