Now Featuring:

Optional support for Beneficial Ownership Information (BOI) reporting.

Ultimate Convenience

-

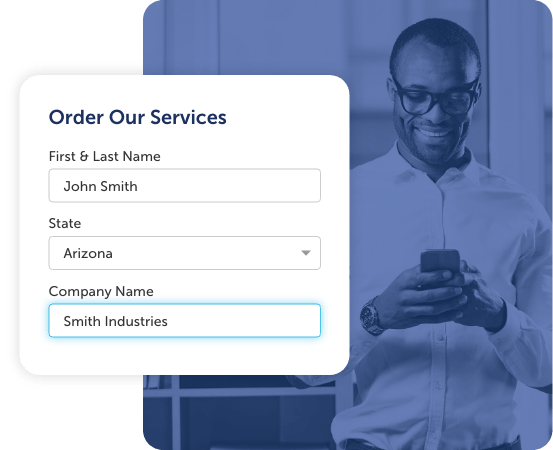

Instant Online Ordering

We make it easy to form your LLC. Simply provide your information in our convenient online form and we’ll take care of the rest. -

Choose Your Speed

Do you need your LLC fast? We can expedite the state’s processing of your LLC and offer several options in most states. Select how fast you want to move when you place your order. -

Service in Every State

Does your tax strategy or privacy needs require your LLC to be formed in a specific state? Form anywhere thanks to our nationwide network of registered agent offices.

The Best Protection

-

Proceed With Confidence

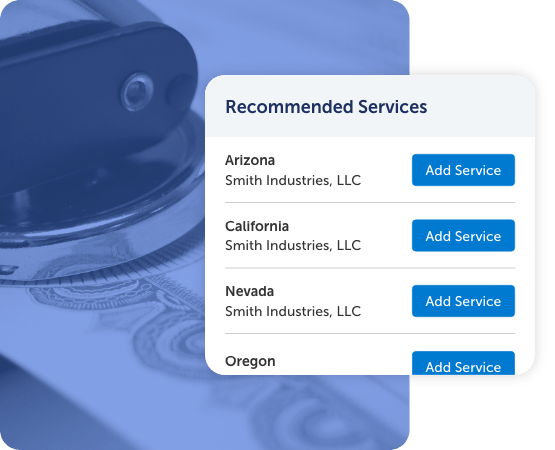

Harness the expertise of our filing experts through Compliance Gaps. As soon as your LLC is formed, Compliance Gaps suggests regulatory filings commonly required of companies like yours in the states where you operate. -

Comprehensive Support

We can help you with any additional registrations or licenses you may need. Our compliance services are a perfect fit for companies that plan to hire employees, sell physical goods, or open offices in other states.

How Our LLC Formation Service Works

Complete the steps below to order our LLC formation services. Once we have submitted your filings, we will track their progress and send confirmation when they are approved.

Form Your LLC

Provide basic information about your new company.

We prepare and submit the required filings to form your LLC.

Receive your approved LLC formation documents.

Experience the Harbor Compliance Difference

Our managed services let you offload the government paperwork to our compliance specialists. Their deep industry expertise and strong working relationships with government agencies mean fast, cost-effective filing and exceptional ROI. We believe in doing it right, so it only has to be done once.

Frequently Asked Questions

An LLC is a business structure formed under state law. It has features of both corporations and partnerships. Like a corporation, it can limit your personal liability as an owner. Like a partnership, you receive pass through taxation and have flexibility in how you will run your business. Read full article “What is an LLC?”.

Liability refers to financial or legal debt. Limited liability means containing the amount of liability an owner has.

An owner who invests a certain amount in a limited liability business structure such as an LLC is only risking the amount of his or her investment. The owner is not personally responsible for debts and obligations of the business that exceed the assets of the business.

An LLC must be properly set up and run to establish and maintain the “corporate veil” that protects owners from liability.

LLCs are the most popular business entity because they are inexpensive to form and easy to run. Forming your LLC legally establishes your business, limits your personal liability, and gains tax flexibility.

The owners of an LLC are called members. Membership is often based on percentage. A single owner LLC contains one member who has 100% ownership. A three member LLC might contain one owner who has a 50% share and two owners who each own a 25% share. Ownership may or may not be documented in membership certificates.

Ownership in an LLC often entitles the owner to a share of the LLC profits or losses and to a right to vote in decisions of the LLC. This governance should be defined in the LLC’s Operating Agreement Template.

Adding and removing owners is accomplished by purchasing or selling percentage ownership from other members. The total percentage ownership should always add up to 100%.

LLCs may be managed by the members (the owners) or by managers. When the LLC is managed by the members, the members make all management decisions. When the LLC elects to be manager manged, the members are responsible for electing manager(s). This election often occurs as part of the annual meeting. A manager-managed LLC may elect a member to serve as a manager.

Choosing to form the LLC as manager-managed offers more flexibility. This way you can elect a member as the manager or elect a non-member manager.

By default, an LLC receives pass-through taxation. It may make a special election to be taxed as an S-Corp or C-Corp.

Most new LLCs keep pass through taxation. Depending on the number of owners, the IRS calls this tax treatment either a “disregarded entity” or a “partnership”. Either way, the business profit or loss passes through to the owners’ personal tax returns. As an owner of the LLC, you simply list your business profits and losses on your personal income tax return. Partnerships also file an information return to the IRS reporting how the profits or losses were divided amongst members. Best of all, many tax preparers do not charge extra for including your LLC in your personal tax return!

An LLC generally does not have specific annual meeting requirements or other “formalities”. LLCs are easier to run than corporations but nevertheless it is important to follow basic guidelines to keep the LLC separate from the owners.

After forming the LLC, you should have an organizational meeting of the owners and adopt an operating agreement template, which documents how the LLC will be run. You should keep company records, including meeting minutes and resolutions. An annual meeting is recommended to demonstrate that you are operating the LLC as a separate entity, not as an extension of yourself.

Some states require the LLC to file an annual report along with a filing fee or franchise tax. This is required for continued authority to conduct business in that state. Keeping up with state law requirements is important to preserve the good standing of the LLC, liability protections, and to avoid government penalties (up to and including administrative dissolution of the LLC). Our compliance coaching will help you learn how to do this.

Attorneys, accountants, and consultants excel when they can stay focused on what they do best: providing legal, tax, and strategic guidance. Let our software and services manage routine filings efficiently and affordably, so you can focus on solving your clients’ most complex problems.

Support To Meet Your Client Needs

Professional services firms are well-positioned to advise clients on how to structure an LLC’s ownership and operating agreement. Harbor Compliance specializes in providing fast, efficient filing processes that complement your advisory services. Maximize your time spent on strategic activities by outsourcing the rest of the LLC formation project to Harbor Compliance. We offer:

- Quick name reservation.

- Expedited state processing of your LLC documents. Walk-in options are available in most states.

- Configurable billing that properly reflects your client’s account or retainer, as needed.

- Customized permissions that allow you to either act as the middleman or grant your clients direct access to the Harbor Compliance portal.

- Use our Entity Manager software to see every state in which an entity is registered and the status in each state. The resulting Entity Health Check is a direct value-add to your clients that can also serve to identify future potential projects for your firm.

We want to support you before, during, and after you form your LLC. Please contact us to speak with a formation specialist.

Additional Resources

For even more education about LLCs, check out our Information Center and Blog.

Choose a Business Structure LLC Startup Guide Limited Liability vs. Liability Insurance Suffix requirements such as "LLC" or "Ltd."