Louisiana Fundraising Licensing

Below, you'll find licensing requirements for a range of fundraising activities. At a glance, you can see requirements, fees, filing instructions, and links to forms for everything from charitable gaming and cause marketing to professional fundraisers and charitable gift annuities.

Make sure your fundraising activities meet the unique requirements of each jurisdiction where you’re soliciting. Feel free to explore, bookmark, and share!

- Jump To:

- Louisiana Nonprofit & Fundraising Company Licenses

- Louisiana Individual Nonprofit & Fundraising Licenses

Company Licenses

Louisiana Nonprofit & Fundraising Company Licenses

Louisiana Charitable Gaming License

| Game Type: | Bingo, raffles, and keno. |

| Agency: | Louisiana Office of Charitable Gaming |

| Organization Age Requirement: | 2 years of continuous existence in Louisiana. |

Initial Registration

| Agency: | Louisiana Office of Charitable Gaming |

| Form: | |

| Agency Fee: | $75 |

| Original Ink: | Not Required |

| Notarization Required?: | Not Required |

Registration Renewal

| Agency: | Louisiana Office of Charitable Gaming |

| Form: | Form OCG2000: Application to Conduct Charitable Gaming (Renewal) |

| Agency Fee: | $75 |

| Due: | Annually by June 30. |

| Original Ink: | Not Required |

| Notarization Required?: | Not Required |

Louisiana Charitable Gift Annuity Registration

Not required

Charitable Gift Annuity licensure is not required on the State level in Louisiana.

No filing is required. Louisiana exempts 501(c)(3) organizations from insurance regulations related to charitable gift annuities.

| Law: | LA Rev. Stat. § 22:951(D) |

Louisiana Charitable Organization Registration

| Agency: | Louisiana Department of Justice - Public Protection Division - Charities |

| Law: | |

| Foreign Qualification is Prerequisite: | No |

| Registered Agent (Special Agency) Required? | Yes |

Automatic Exemption

| Exemption Eligible Organizations: | Charities that do not use professional solicitors or fundraising counsels |

| Law: | |

| Notes: |

|

One-Time Exemption Registration

| Exemption Eligible Organizations: |

|

| Form: | |

| Instructions: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $0 |

| Law: | |

| Original Ink: | Not Required |

| Notarization Required?: | Required |

| Notes: | Exemptions do not expire as long as the organization continues to qualify under the exemption criteria. |

| Required Attachments: | To apply for exemption based upon educational institution:

To apply for exemption based upon religious institution:

|

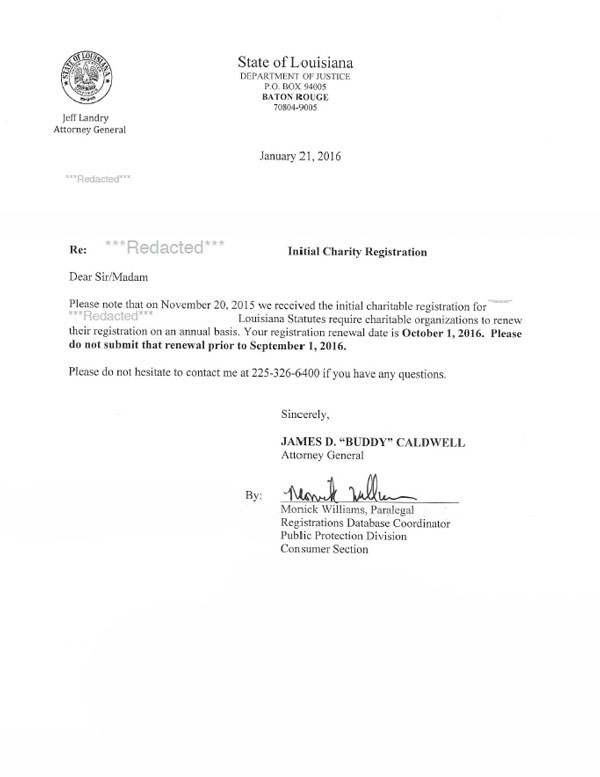

Initial Registration

| Form: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $25 |

| Turnaround: | 4-6 weeks |

| Original Ink: | Not Required |

| Notarization Required?: | Required |

| Notes: |

|

| Before you Apply: | Domestic Applicants:

Foreign Applicants:

|

| How to Apply: | Domestic Applicants:

Foreign Applicants:

|

| Required Attachments: |

|

Registration Renewal

| Form: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $25 |

| Due: | Annually by the date of initial registration. |

| Original Ink: | Not Required |

| Notarization Required?: | Required |

| Required Attachments: |

|

Reinstatement

Not required

Formal reinstatement is not required. Charities wishing to reinstate an expired registration must submit a renewal application with all the necessary documents and fees.

Change of Fiscal Year

| Form: | |

| Filing Method: | |

| Agency Fee: | $0 |

| Notes: | Your fiscal year can be updated during the standard renewal process. |

Cancelation

| Filing Method: | |

| Agency Fee: | $0 |

| Notes: | To close out your registration, send a signed letter indicating the organization is no longer required to maintain an active registration (does not use professional solicitors) in Louisiana. |

Louisiana Commercial Co-Venturer Registration

Not required

Commercial Co-venturer licensure is not required on the State level in Louisiana.

Louisiana does not currently have a traditional registration requirement for commercial co-venturers, but they may need to follow other regulations before and after fundraising events.

Louisiana Fundraising Counsel Registration

Not required

Fundraising Counsel licensure is not required on the State level in Louisiana.

Louisiana does not currently have a traditional registration requirement for fundraising counsels, but they may need to follow other regulations before and after fundraising events.

A professional solicitor generally is a person or corporation who is paid by a charity to raise money or create a charity’s donation campaign on the charity's behalf. Employees or volunteers of a charity who raise funds for that charity are not professional solicitors.

Louisiana Professional Solicitor Registration

| Agency: | Louisiana Department of Justice - Public Protection Division - Charities |

| Bond Requirements: | $25,000 |

Initial Registration

| Form: | |

| Agency Fee: | $150 |

| Original Ink: | Not Required |

| Notarization Required?: | Required |

| Before you Apply: |

|

| Required Attachments: |

|

Registration Renewal

| Form: | |

| Agency Fee: | $150 |

| Due: | Annually by the anniversary date of initial registration. |

| Original Ink: | Not Required |

| Notarization Required?: | Required |

Contract Filing

| Form: | |

| Agency Fee: | $0 |

| Due: | File a notice of commencement of solicitation at least 10 days prior to the start of the performance of the contract. |

Individual Licenses

Louisiana Individual Nonprofit & Fundraising Licenses

Louisiana Individual Professional Fundraiser Registration

Not required

Professional Solicitor licensure is not required on the State level in Louisiana.

Solicitors who are not employed by a professional fundraising firm but operate independently may be required to register. Employees of professional fundraising firms are generally not required to register as an individual solicitor in Louisiana.