Easily Complete the Dissolution and Withdrawal Process

When it comes time to close your business, dissolution or withdrawal is the proper way to wind down operations. By doing so, you eliminate the risk of accruing penalties, having ongoing obligations to the states, and facing costly reinstatement fees should you choose to resume operations in the future.

Generally, withdrawal (also called cancellation in some states) refers to closing a registration in a state that is not the state of formation. Dissolution closes the entity in the state where it was formed. Simply let us know where you want to close your entity registration, and we’ll complete the appropriate filings for that state.

Shutting down an entity registration is complex. Failing to follow the correct process can add months to the timeline. Don’t spend weeks or months researching requirements and filing with multiple government agencies. We’ll prepare the necessary forms and provide instruction on how to obtain tax clearance if required to close your registrations.

Ultimate Convenience

-

Minimize your time investment

When it comes to closing entity registrations, completing the forms is the easy part. Researching the requirements, submitting the forms properly to the right agency and in the right order, monitoring them for approval, and following up is where the real effort is spent. If the process is not completed properly, this seemingly simple project can take months if not over a year. We complete each step so you can achieve the best outcome in the least amount of time. -

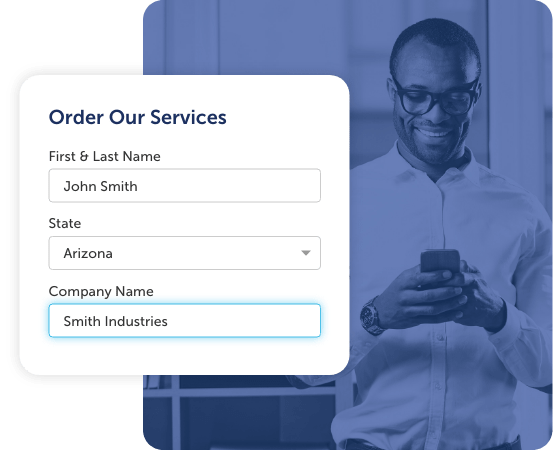

Instant Online Ordering

We make it easy to dissolve your entity. Simply provide your information in our convenient online form and we’ll take care of the rest. -

Choose Your Speed

Do you need the process to be completed quickly? Where offered by the state, we can expedite the filing processing times. Select how fast you want to move when you place your order. -

Service in Every State

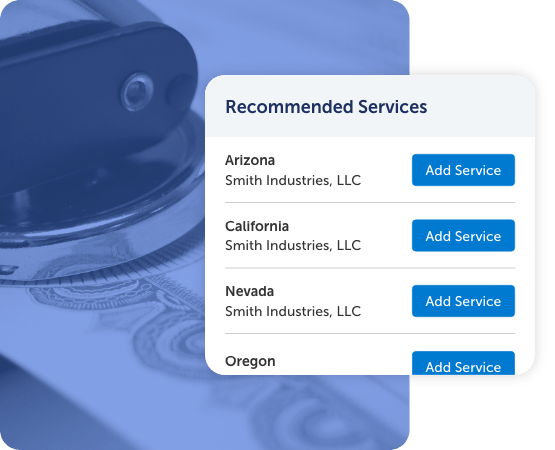

No matter where your business is registered, we can help. We provide support across all 50 states, the District of Columbia, and Puerto Rico.

The Best Protection

-

Tax Clearance Support

Many states require official notice of tax clearance from their department of revenue before dissolution or withdrawal can be approved. Since these departments only communicate with taxpayers and their tax preparers, we provide you with the information needed to pursue tax clearance on your own. -

Entity Status Issues Solved

States will require your entity registration to be in good standing before it can be wound down. We will identify your entity status at the start of the project. If it’s out of good standing, we can reinstate it and handle any backdue annual reports so your paperwork can proceed without delay.

How Our Dissolution And Withdrawal Service Works

Complete the online form to order our dissolution and withdrawal services. Once we have submitted your filings, we will track their progress and send confirmation when they are approved.

Dissolving Your Entity

Provide basic information about your organization, including how fast you want to move.

Get StartedWe identify the steps necessary to withdraw or dissolve your entity, invoice applicable filing fees, and file the withdrawal or dissolution paperwork.

Any required back-due filings such as annual reports are billed separately.

Receive your proof of withdrawal or dissolution.

Harbor Compliance not only met, but exceeded my expectations. Very courteous and knowledgeable staff. Turn-around time was nothing short of a miracle. Thanks you so much Harbor Compliance, you came through when I needed it most!

Patrick Blazer Inspection, Inc.Frequently Asked Questions

Filing dissolution paperwork with the state ends the life of your entity cleanly, and reduces your risk of penalties, as you wrap up affairs.

As organizations cease operations, often the last thing on their mind is filing dissolution paperwork with the state. As a result, many entities are administratively (or involuntarily) dissolved by the state for failure to maintain good standing, or to keep up with compliance requirements.

Those that are involuntarily dissolved often face state penalties, and the owners face a loss of liability protection. Entities that are not in good standing also run the risk of default judgment in court.

Filing withdrawal paperwork with the state closes your entity’s registration cleanly, and reduces your risk of penalties, as you wrap up affairs in that state. Entities that no longer provide service in a state sometimes allow their legal registration to lapse, resulting in a loss of good-standing. Entities that lose good-standing may find themselves subject to local taxes and penalty fees despite having ceased operations in that state.

Achieving tax clearance means receiving approval from various state departments, usually the department of revenue, that an entity is free of its tax obligations in the state. Depending on your state, and the type of entity registration you are withdrawing, you may be required to obtain tax clearance from the state’s department of revenue or taxation authority.

Back-due annual reports annual whose original deadlines have been missed. Organizations must provide reports, generally each year, to the Secretary of State in each state where they are registered. States require organizations to catch up on over-due annual reports from prior years before allowing withdrawal. We can complete any back-due annual reports that the state requires you to submit.

To withdraw an entity registration is to cancel its foreign registration in a state besides the one it was formed in. To dissolve an entity is to wind it down in the state in which it was formed. If your entity is registered to operate in multiple states, you would withdraw it from the states where it’s foreign qualified and dissolve it in its home state.

Free Reference

How to Dissovle a Business or NonprofitReference this online guide for information on how to dissolve your entity in any state.

Obtain a Certificate of Withdrawal or CancellationReference this online guide for information on how to obtain a certificate of withdrawal or cancellation in any state.