New Hampshire Fundraising Licensing

Below, you'll find licensing requirements for a range of fundraising activities. At a glance, you can see requirements, fees, filing instructions, and links to forms for everything from charitable gaming and cause marketing to professional fundraisers and charitable gift annuities.

Make sure your fundraising activities meet the unique requirements of each jurisdiction where you’re soliciting. Feel free to explore, bookmark, and share!

- Jump To:

- New Hampshire Nonprofit & Fundraising Company Licenses

- New Hampshire Individual Nonprofit & Fundraising Licenses

Company Licenses

New Hampshire Nonprofit & Fundraising Company Licenses

New Hampshire Bingo License

Initial Registration

| Agency: | New Hampshire Lottery Commission - Racing and Charitable Gaming Division |

| Form: | |

| Agency Fee: | $25 per game date. |

New Hampshire Charitable Gift Annuity Registration

Initial Registration

| Form: | Certification Required by Charitable Organizations That Issue Charitable Gift Annuities |

| Agency Fee: | $0 |

| Notes: | New Hampshire charities must provide notice on the day they first enter into a charitable gift annuity agreement. Notices must identify the organization, certify that the organization is a charity and that the annuities issued are limited to qualified charitable gift annuities, and be signed by an officer or director. |

Registration Renewal

| Form: | Certification Required by Charitable Organizations That Issue Charitable Gift Annuities |

| Agency Fee: | $0 |

| Due: | Annually |

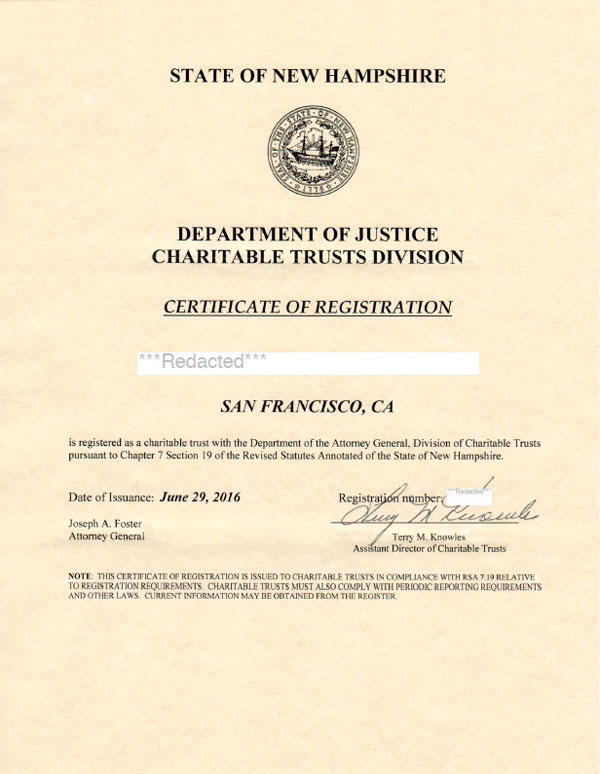

New Hampshire Charitable Organization Registration

| Agency: | New Hampshire Department of Justice - Charitable Trusts Unit |

| Law: | |

| Foreign Qualification is Prerequisite: | No |

| Registered Agent (Special Agency) Required? | No |

Automatic Exemption

| Exemption Eligible Organizations: |

|

| Law: | |

| Notes: |

|

Initial Registration

| Form: | |

| Instructions: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $25 |

| Turnaround: | 4-6 weeks |

| Original Ink: | Not Required |

| Notarization Required?: | Not Required |

| Notes: |

|

| Before you Apply: | Domestic Applicants:

Foreign Applicants:

|

| How to Apply: | Domestic Applicants:

Foreign Applicants:

|

| Required Attachments: |

|

Registration Renewal

| Form: | |

| Instructions: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $75 |

| Due: |

|

| Due Date Extension: | Due dates can be extended for 6 months beyond the original due date by submitting an Application for Extension of Time to File Annual Report along with the $75 renewal fee. |

| Original Ink: | Not Required |

| Notarization Required?: | Not Required |

| Notes: |

|

| Required Attachments: |

|

Contract Filing

| Form: | |

| Filing Method: | |

| Agency Fee: | $0 |

| Turnaround: | 1-2 business days. |

| Due: | A notice of contract must be filed prior to the commencement of every charitable sales promotion. |

| Notes: | The agreement must be signed by an authorized representative of the charitable trust and the commercial co-venturer and it must include, at a minimum, the following:

|

| How to Apply: | The charity must be registered to solicit charitable contributions or otherwise exempt for the contract to be accepted. |

Reinstatement

Not required

Formal reinstatement is not required. Late renewals can be submitted in perpetuity. If an organization has an outstanding report longer than 6 months then they will no longer be in good standing. To get back into good standing, organizations should submit reports for each year they have been out of compliance and the required fee(s) for each report. There are no late fees. An organization will be reactivated once these reports and fees have been received using the same registration number.

Change of Fiscal Year

| Filing Method: | |

| Agency Fee: | $0 |

| Notes: | Fiscal year can be updated during the standard renewal process. You must file the annual report at the close of the previous fiscal year and again at the close of the new fiscal year. Make sure to submit both the short and long-form 990s. |

Cancelation

| Form: | NHCT-16: Withdrawal of Registration of Foreign Nonprofit Corporation |

| Filing Method: | Mail or Online |

| Agency Fee: | $0 |

| Notes: |

|

New Hampshire Commercial Co-Venturer Registration

Not required

Commercial Co-venturer licensure is not required on the State level in New Hampshire.

New Hampshire does not currently have a traditional registration requirement for commercial co-venturers, but they may need to follow other regulations before and after fundraising events.

Contract Filing

| Form: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $0 |

| Due: | A notice of contract must be filed prior to the commencement of every charitable sales promotion. |

| Notes: | The agreement must be signed by an authorized representative of the charitable trust and the commercial co-venturer and it must include, at a minimum, the following:

|

Contract Amendment

| Agency Fee: | $0 |

| Due: | An amendment filing should be made before the expiration date of a campaign in order to extend the campaign. |

| Notes: | To report an extension of a campaign or another change to a campaign agreement, submit a cover letter describing the change and include a copy of the amended agreement. |

Fund Raising Counsel are individuals or entities that are hired by a charitable organization to plan a fundraising campaign, but who do not solicit or collect funds for the charity. Fund Raising Counsel are required to register with the Charitable Trusts Unit annually, pay a filing fee, and submit copies of any contracts between the Fund Raising Counsel and the charitable organization.

New Hampshire Fundraising Counsel Registration

| Agency: | New Hampshire Department of Justice - Charitable Trusts Unit |

Initial Registration

| Form: | |

| Agency Fee: | $150 |

| Original Ink: | Not Required |

| Notarization Required?: | Required |

Registration Renewal

| Form: | |

| Agency Fee: | $150 |

| Due: | Annually |

| Original Ink: | Not Required |

| Notarization Required?: | Required |

Contract Filing

| Form: | |

| Agency Fee: | $0 |

| Due: | File a notice of contract or the contract prior to the start of the performance of a contract with a charity. |

New Hampshire Games of Chance License

| Game Type: | Various games of chance |

| Agency: | New Hampshire Lottery Commission - Racing and Charitable Gaming Division |

Initial Registration

| Agency: | New Hampshire Lottery Commission - Racing and Charitable Gaming Division |

| Form: | |

| Agency Fee: | $25 per game date. |

New Hampshire Lucky 7 License

Initial Registration

| Agency: | New Hampshire Lottery Commission - Racing and Charitable Gaming Division |

| Form: | |

| Agency Fee: | $10 per month. |

Paid Solicitors are individuals or entities that are hired by a charitable organization to conduct a fundraising campaign on behalf of the charity. Paid Solicitors generally retain a percentage of the funds raised as payment for their services. Paid Solicitors are required to register with the Charitable Trusts Unit annually, post a $20,000 bond, and pay a filing fee. Paid Solicitors seeking to conduct a telemarketing or fundraising campaign on behalf of a charitable organization must first obtain a permit from the Charitable Trusts Unit. The Paid Solicitor must file an application and pay a filing fee for each campaign.

New Hampshire Paid Solicitor Registration

| Agency: | New Hampshire Department of Justice - Charitable Trusts Unit |

| Bond Requirements: | $20,000 |

Initial Registration

| Form: | Form NHCT-21: Application for Registration of Paid Solicitor |

| Filing Method: | Mail or online. |

| Agency Fee: | $500 |

| Notarization Required?: | Required |

| Before you Apply: |

|

Registration Renewal

| Form: | Form NHCT-21: Application for Registration of Paid Solicitor (Renewal) |

| Filing Method: | Mail or online. |

| Agency Fee: | $500 |

| Due: | Annually |

| Notarization Required?: | Required |

Contract Filing

| Form: | |

| Agency Fee: | $200 |

| Due: | Prior to the commencement of each solicitation campaign, the paid solicitor shall file with the attorney general a completed "solicitation notice'' on forms prescribed by the attorney general. |

Financial Reporting

| Form: | |

| Agency Fee: | $0 |

| Due: | Within 90 days after a campaign has ended and on the anniversary of commencement for campaigns lasting more than a year. |

| Notarization Required?: | Required |

Individual Licenses

New Hampshire Individual Nonprofit & Fundraising Licenses

New Hampshire Individual Professional Fundraiser Registration

Not required

Professional Solicitor licensure is not required on the State level in New Hampshire.

Solicitors who are not employed by a professional fundraising firm but operate independently may be required to register. Employees of professional fundraising firms are generally not required to register as an individual solicitor in New Hampshire.