Arkansas Fundraising Licensing

Below, you'll find licensing requirements for a range of fundraising activities. At a glance, you can see requirements, fees, filing instructions, and links to forms for everything from charitable gaming and cause marketing to professional fundraisers and charitable gift annuities.

Make sure your fundraising activities meet the unique requirements of each jurisdiction where you’re soliciting. Feel free to explore, bookmark, and share!

- Jump To:

- Arkansas Nonprofit & Fundraising Company Licenses

- Arkansas Individual Nonprofit & Fundraising Licenses

Company Licenses

Arkansas Nonprofit & Fundraising Company Licenses

Arkansas Annual Bingo and Raffle License

Initial Registration

| Agency: | Arkansas Department of Finance and Administration - Miscellaneous Tax Section |

| Form: | AR-1R-BRLAO: Bingo and Raffle Registration Licensed Authorized Organizations Supplement |

| Agency Fee: | $100 |

| Law: | AR Code Ann. § 23-114-101 et seq. |

Registration Renewal

| Agency: | Arkansas Department of Finance and Administration - Miscellaneous Tax Section |

| Form: | AR-1R-BRLAO: Bingo and Raffle Registration Licensed Authorized Organizations Supplement (Renewal) |

| Agency Fee: | $100 |

| Due: | Annually by the fiscal year end of the licensed organization. |

Arkansas Charitable Gift Annuity Registration

Initial Registration

| Form: | |

| Agency Fee: | $0 |

| Notarization Required?: | Required |

| Notes: | Charities must authorize the creation of the annuity fund by board resolution and must create a segregated reserve fund to qualify for issuance of charitable gift annuities. |

Registration Renewal

| Form: | |

| Agency Fee: | $0 |

| Due: | Annually within 180 days of the organization's fiscal year end. |

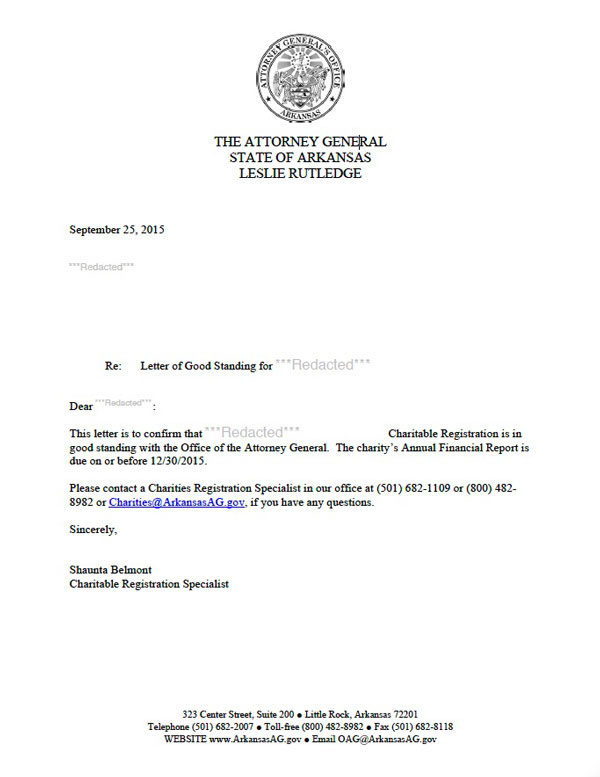

Arkansas Charitable Organization Registration

| Agency: | Arkansas Secretary of State - Business and Commercial Services Division (BCS) - Charities Bureau |

| Law: | |

| Foreign Qualification is Prerequisite: | No |

| Registered Agent (Special Agency) Required? | No |

One-Time Exemption Registration

| Exemption Eligible Organizations: |

|

| Form: | |

| Filing Method: | Email to charities@sos.arkansas.gov |

| Agency Fee: | $0 |

| Law: | |

| Notarization Required?: | Required |

| Notes: |

|

| Required Attachments: |

|

Initial Registration

| Form: | |

| Instructions: | |

| Filing Method: | File by mail or email to charities@sos.arkansas.gov. |

| Agency Fee: | $0 |

| Turnaround: | 1-2 weeks |

| Original Ink: | Not Required |

| Notarization Required?: | Required |

| Notes: |

|

| Before you Apply: | Domestic Applicants:

Foreign Applicants:

|

| How to Apply: | Domestic Applicants:

Foreign Applicants:

|

| Required Attachments: |

|

Registration Renewal

| Form: | |

| Filing Method: | Mail or email to charities@sos.arkansas.gov. |

| Agency Fee: | $0 |

| Due: |

|

| Due Date Extension: | Due dates can be extended for 6 months beyond the original due date by emailing the secretary of state at charities@sos.arkansas.gov and including the words “Annual Financial Report Extension” in the subject line of the email. |

| Original Ink: | Not Required |

| Notarization Required?: | Required |

| Required Attachments: |

|

Contract Filing

| Form: | |

| Filing Method: | Email to charities@sos.arkansas.gov |

| Agency Fee: | $0 |

| Turnaround: | 1-2 business days |

| Due: | Every charitable organization subject to the registration requirements of A.C.A. § 4-28-402 that agrees to permit a charitable sales promotion to be conducted in its behalf shall obtain a written agreement from the commercial coventurer and file a copy of the agreement with the Secretary of State before the commencement of the charitable sales promotion within this state. |

| Original Ink: | Not Required |

| Notarization Required?: | Not Required |

| Notes: | An authorized representative of the charitable organization and the commercial coventurer must sign the agreement, and the terms of the agreement shall include at a minimum the following:

|

| How to Apply: | The charity must be registered to solicit charitable contributions or otherwise exempt for the contract to be accepted. |

Reinstatement

Not required

Formal reinstatement is not required. Charities that have been out of compliance for less than 5 years and were not voluntarily closed or withdrawn must submit renewal filings and the required financials for each year not registered since the last filing. Charities that have been out of compliance for over 5 years and were not voluntarily closed or withdrawn must submit a new initial filing with updated copies of all the required documents and financials for the last 5 years. Charities that were voluntarily closed or withdrawn (registration status will show as 'Close' with the Charities Bureau) only need to submit a new initial filing (no financials from years not registered will be required for these charities).

Change of Fiscal Year

| Form: | |

| Agency Fee: | $0 |

| Turnaround: | 1-2 business days |

| Notes: | File the short year form with the updated fiscal year information. |

Cancelation

| Filing Method: | Email to charities@sos.arkansas.gov |

| Agency Fee: | $0 |

| Notes: | To close out your registration, send a signed and dated letter stating that you would like to withdraw. The request must list the last date of solicitation in Arkansas and all financial reports on file must be current to that date. |

Arkansas Class I Temporary Raffle License

| Game Type: | Raffles |

| Agency: | Arkansas Department of Finance and Administration - Miscellaneous Tax Section |

| Law: | AR Code Ann. § 23-114-101 et seq. |

Initial Registration

| Agency: | Arkansas Department of Finance and Administration - Miscellaneous Tax Section |

| Form: | AR-1R-BRLAO: Bingo and Raffle Registration Licensed Authorized Organizations Supplement |

| Agency Fee: | $25 |

| Law: | AR Code Ann. § 23-114-101 et seq. |

Arkansas Class II Temporary Raffle License

Initial Registration

| Agency: | Arkansas Department of Finance and Administration - Miscellaneous Tax Section |

| Form: | AR-1R-BRLAO: Bingo and Raffle Registration Licensed Authorized Organizations Supplement |

| Agency Fee: | $10 |

| Law: | AR Code Ann. § 23-114-101 et seq. |

Commercial coventurer means any person who for profit or other consideration is regularly and primarily engaged in trade or commerce other than in connection with the raising of funds or any other thing of value for a charitable organization and who advertises that the purchase or use of his or her goods, services, entertainment, or any other thing of value normally sold without a charitable appeal will benefit a charitable organization during a charitable sales promotion.

Arkansas Commercial Co-Venturer Registration

Not required

Commercial Co-venturer licensure is not required on the State level in Arkansas.

Arkansas does not currently have a traditional registration requirement for commercial co-venturers, but they may need to follow other regulations before and after fundraising events.

Contract Filing

| Form: | |

| Filing Method: | Email to charities@sos.arkansas.gov |

| Agency Fee: | $0 |

| Due: | A copy of the written agreement between the charity and commercial coventurer must be filed with the Secretary of State before the commencement of the charitable sales promotion. |

| Notes: | An authorized representative of the charitable organization and the commercial coventurer must sign the agreement, and the terms of the agreement must include, at a minimum, the following:

|

Contract Amendment

| Agency Fee: | $0 |

| Due: | An amendment filing should be made before the expiration date of a campaign in order to extend the campaign. |

| Notes: | To report an extension of a campaign or another change to a campaign agreement, submit a cover letter describing the change and include a signed copy of the amended agreement. |

Fund-raising counsel means any person who for a flat fixed fee or fixed hourly rate under a written agreement plans, conducts, manages, carries on, advises, or acts as a consultant, whether directly or indirectly, in connection with soliciting contributions for or on behalf of any charitable organization, but who actually solicits no contributions as a part of the services.

Arkansas Fundraising Counsel Registration

| Agency: | Arkansas Secretary of State - Business and Commercial Services Division (BCS) |

| Law: |

Initial Registration

| Form: | Form FC-01: Fundraising Counsel Annual Application for Registration |

| Agency Fee: | $100 |

| Notarization Required?: | Required |

| Before you Apply: |

|

| Required Attachments: |

|

Registration Renewal

| Form: | Form FC-01: Fundraising Counsel Annual Application for Registration (Renewal) |

| Agency Fee: | $100 |

| Due: | Annually by the date of issuance. |

| Notarization Required?: | Required |

Contract Filing

| Agency Fee: | $0 |

| Due: | Changes to any of the information submitted on the registration application must be reported within 30 days of the changes occurring, including new contract agreements. |

| Notes: | The contract must contain any information that will enable the Secretary of State to identify the services the fund-raising counsel is to provide and the manner of his or her compensation. |

Amendment

| Agency Fee: | $0 |

| Due: | Changes to any of the information submitted on the registration application must be reported within 30 days of the changes occurring. |

Paid solicitor means a person who for compensation, other than any nonmonetary gift of nominal value awarded to a volunteer solicitor as an incentive or token of appreciation, performs for a charitable organization any service in connection with which contributions are solicited by the person or by any other person he or she employs, procures, or engages to solicit for compensation.

Arkansas Paid Solicitor Registration

| Agency: | Arkansas Secretary of State - Business and Commercial Services Division (BCS) |

| Law: | |

| Bond Requirements: | $10,000 |

Initial Registration

| Form: | Form PS-01: Paid Solicitor Annual Application for Registration |

| Agency Fee: | $200 |

| Notarization Required?: | Required |

| Notes: | The application for registration and all required attachments must be submitted |

| Before you Apply: |

|

| Required Attachments: |

|

| Bond Amount: | $10,000.00 |

Registration Renewal

| Form: | Form PS-01: Paid Solicitor Annual Application for Registration (Renewal) |

| Agency Fee: | $200 |

| Due: | Annually by the date of issuance. |

Contract Filing

| Form: | |

| Agency Fee: | $0 |

| Due: | File a notice of entry into contract at least 15 days prior to the start of the performance of the contract. |

| Notarization Required?: | Required |

| Notes: | A contract between a paid solicitor and a charitable organization must:

|

Financial Reporting

| Form: | |

| Agency Fee: | $0 |

| Due: | Within 90 days after a campaign has ended and on the anniversary of commencement for campaigns lasting more than a year. |

| Notarization Required?: | Required |

Arkansas Temporary Bingo License

| Game Type: | Bingo |

| Agency: | Arkansas Department of Finance and Administration - Miscellaneous Tax Section |

| Law: | AR Code Ann. § 23-114-101 et seq. |

Initial Registration

| Agency: | Arkansas Department of Finance and Administration - Miscellaneous Tax Section |

| Form: | AR-1R-BRLAO: Bingo and Raffle Registration Licensed Authorized Organizations Supplement |

| Agency Fee: | $25 |

| Law: | AR Code Ann. § 23-114-101 et seq. |

Individual Licenses

Arkansas Individual Nonprofit & Fundraising Licenses

Arkansas Professional Telemarketer Registration

| Agency: | Arkansas Secretary of State - Business and Commercial Services Division (BCS) |

Initial Registration

| Form: | Form PT-01: Professional Telemarketer Annual Application for Registration |

| Agency Fee: | $10 |

Registration Renewal

| Form: | Form PT-01: Professional Telemarketer Annual Application for Registration (Renewal) |

| Agency Fee: | $10 |

| Due: | Annually |