South Carolina Charity Registration Process: Requirements, Exemptions, and Application

Charitable organizations in South Carolina must meet specific requirements before they can solicit contributions or have contributions solicited on their behalf. These requirements typically include completing the South Carolina charitable registration process with the secretary of state and filing financial statements.

Certain charitable organizations may qualify for exemptions from registration and filing. However, these entities must still adhere to state-specific requirements. Failure to fulfill these obligations can result in significant penalties, including fines and reputation damage.

Keeping track of these complex, ever-evolving state requirements can consume a lot of energy and time, but this is where Harbor Compliance’s expertise helps.

In this article, we’ll provide a detailed overview of the South Carolina charity registration process, exemptions, and filing requirements. Additionally, we will highlight how Harbor Compliance’s Charitable Registration Service can ensure your entity meets state filing requirements with ease.

What Is the South Carolina Charitable Solicitation Registration?

The South Carolina charity registration is mandatory for most organizations established for social welfare, educational, philanthropic, or benevolent purposes. These organizations must complete the registration process before soliciting contributions or allowing others to solicit on their behalf.

The Solicitation of Charitable Funds Act governs the operations of charity organizations in South Carolina. Under the Act, contributions are broadly defined to include:

- Grants

- Monetary pledges

- Credit

- Property of any value

However, contributions do not include dues, assessments, or sponsorships paid by an organization’s members, provided the membership does not depend on contributions made in response to a solicitation. Furthermore, solicitation is considered to occur regardless of whether the entity requesting the contribution receives it.

Exemptions to the SC Charity Registration Process

Several entities are exempt from the charity registration process in South Carolina. These entities can be:

- Exempt from filing with the South Carolina secretary of state

- Exempt from registering with the secretary of state

Entities Exempt From Filing With the South Carolina Secretary of State

Charity organizations that are not required to file include:

- Churches, mosques, synagogues, or other congregations organized for divine worship. This also includes religious organizations recognized by the Internal Revenue Service (IRS) as tax-exempt and not required to file IRS Form 990, 990-EZ, or 990-PF.

- Candidates for national, state, local office, political parties, or groups required to file information with the State Ethics Commission or Federal Election Commission.

Exemptions From Registering With the Secretary of State

Entities exempt from registration with the South Carolina secretary of state are divided into two categories. The first includes organizations that only qualify for the exemption, provided their fundraising activities are not conducted by commercial co-venturers, professional solicitors, or professional fundraising counsel.

Such entities include:

- Educational institutions soliciting contributions solely from their students and their families, alumni, corporations, trustees, or individuals supportive of their programs

- Organizations that solicit solely from its members

- Veterans’ organizations with a congressional charter

- Charitable organizations that do not intend to solicit or receive contributions exceeding $20,000 in a calendar year

- Individuals soliciting contributions for the relief of another named individual, provided all contributions are turned over to the beneficiary without any deductions

- IRS tax-exempt organizations whose assets or income do not benefit any officer or member. Their activities must also be conducted by individuals who are compensated less than $500 per year for their services

The second category includes entities exempt from registration regardless of whether professional fundraising counsel, commercial co-venturers, or professional solicitors conduct their fundraising activities:

- Organizations that do not intend to solicit or receive contributions exceeding $7,500 during a calendar year. If they receive more than this amount, they must register and report to the secretary of state within 30 calendar days.

- Public school districts in the state and any public school teaching pre-K through grade 12 within the district.

The Requirements for the SC Secretary of State Charity Registration

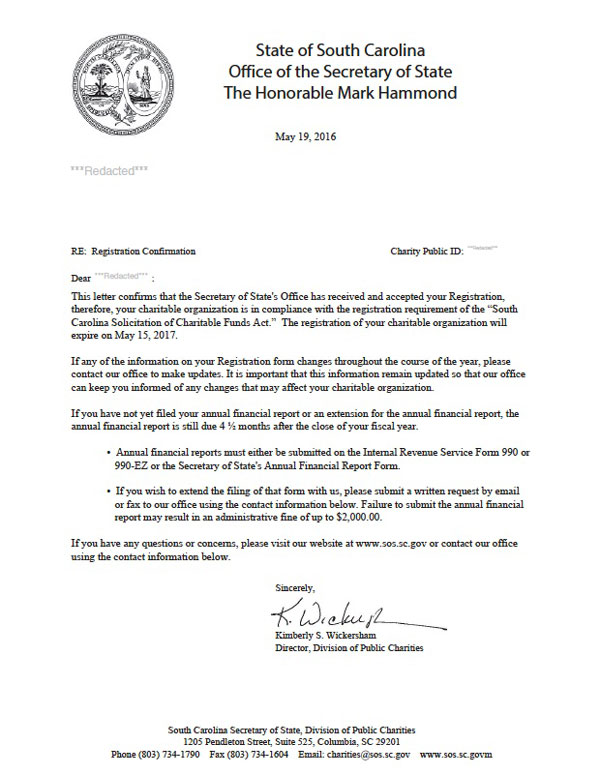

Most charity organizations operating in South Carolina must complete the secretary of state charitable registration process. This involves filing two documents:

- Registration Statement for Charitable Organizations

- Secretary of State Annual Financial Report and the IRS Form 990, 990-EZ, or 990-PF

You should only submit the IRS Form 990, 990-EZ, or 990-PF if the annual financial report hasn’t already been submitted to the department and no extension was granted by the IRS. If the extension was granted, you need to submit a copy of the extension request/approval with the annual financial report.

Furthermore, nonexempt organizations must renew their registrations annually by submitting these documents to the secretary of state.

Entities exempt from registering with the secretary of state must file an Application for Exemption and submit it annually to renew their exemption. If an organization ceases to qualify for an exemption, it must promptly register as a charitable organization to continue soliciting contributions legally.

Penalties for Not Fulfilling the SC Charitable Registration

Fulfilling the requirements for SC charity registration is mandatory for nonprofits in the state. Failure to register and renew your registration or exemption annually can result in administrative fines, damage relationships with existing donors, and hinder your ability to attract future contributors.

To avoid these consequences, it’s essential to prioritize the state’s charitable registration requirements by ensuring timely filings each year.

Completing the South Carolina Charity Registration Process

To begin the South Carolina charitable registration process, your organization must provide the following:

- Tax-exemption status—Organizations that have already been granted tax exemption must upload the determination letter issued by the IRS during their first registration. If your entity has applied for tax exemption but hasn’t been approved, select “No” when asked if it is tax-exempt. Once the IRS grants the tax-exempt status, upload a copy of the determination letter to your dashboard.

- Financial report—Your entity must submit the secretary of state’s annual report or one of the IRS forms (990, 990-EZ, or 990-PF) for the most recent fiscal year available.

- South Carolina Secretary of State Registration Statement for a Charitable Organization—This document requires details about your entity, including its legal name, the purpose for which it was formed, its principal address, and information on its officers. The filing fee for the Registration Statement is $50, and if you’re filing online, there’s an additional $1.85 online filing fee.

Each year, your entity will be required to renew its registration. This can be done by submitting the financial report and Registration Statement.

If your organization qualifies for a registration exemption, you only need to file an Application for Exemption with the secretary of state. This can be done online or by mail. You must also submit this exemption application annually.

Managing the South Carolina Charity Registration Process Independently—Potential Challenges

Navigating the South Carolina charitable registration process can be complex and time-consuming. If your organization is not exempt, you must complete the initial registration process, submit the required documents, and ensure you file annually to avoid administrative penalties.

Even exempt organizations face obligations as they must file the exemption statement annually. Should your organization no longer meet the exemption criteria, you must complete the initial registration process and renew annually.

Keeping track of these responsibilities can be overwhelming, especially when balancing critical tasks like soliciting contributions and managing your organization’s operations. Managing the charity registration process requires monitoring changing requirements, completing all necessary forms, and filing annually. Failure to do so could result in fines and harm your relationship with donors.

Many organizations entrust their charitable registration to experts like Harbor Compliance to avoid these risks. This streamlines the process and ensures peace of mind.

Overseeing the South Carolina Charitable Solicitation Registration With Harbor Compliance

Harbor Compliance is a trusted provider that helps organizations navigate complex regulatory requirements, including South Carolina fundraising registration.

With years of experience filing tens of thousands of registrations annually, we have a deep understanding of regulatory requirements. Our expertise ensures that your organization meets its obligations before soliciting funds, helping you avoid penalties.

Harbor Compliance’s leadership in the industry has been further strengthened by its acquisition of Labyrinth, Inc., the largest provider of charitable registration services in the U.S. Today, we manage over 60% of registrations for organizations operating in 38 states, providing unmatched support and guidance.

Our Charitable Registration Service includes:

- An assigned registration specialist

- Power of Attorney option, which allows us to handle the signing of many applications on your behalf

- Transparent payments with no upfront costs until requirements and project plans are fully established

Beyond charitable registration, Habor Compliance supports your nonprofit in meeting critical operational needs, such as:

- Registered Agent Service—We have local offices nationwide to handle legal correspondence for your nonprofit.

- Foreign Qualification Service—Simplify expansion to other states with our expert guidance.

- Tax exemption filing—We handle the complexities of applying for tax-exempt status so you can focus on meeting your entity’s goals.

How To Order Harbor Compliance Charitable Registration, Renewal, and Compliance Service

If you would like to simplify your nonprofit’s charitable registration and renewal process, Harbor Compliance offers easy-to-follow steps to order our services:

- Visit the Charitable Registration Service page.

- Select Contact Us.

- Fill out the online form with your contact details.

- Submit the form.

Additionally, we offer two free white papers titled Charitable Solicitation Compliance and Charitable Registration - Navigating the Complexities, which you can easily download to learn more about regulatory obligations nonprofits face.

Harbor Compliance’s Other Services

In addition to supporting charitable registration and multistate expansion, Harbor Compliance provides various services to help organizations meet diverse regulatory obligations. Our expertise spans various compliance areas, ensuring your entity operates smoothly. The table below highlights the services we offer:

| Service Category | Services |

|---|---|

| Nonprofit formation | We assist nonprofit organizations in filing formation documents to the designated regulatory authority. |

| Business licensing support | We help entities file for and secure general business licenses and industry permits in sectors, such as engineering and construction. |

| Tax services | Our tax services include setting up payroll and sales and use tax accounts. We also help entities secure Employer Identification Numbers (EINs). |

| Entity lifecycle management | Our corporate lifecycle management services include LLC formation, incorporation, amendment, reinstatement, name reservation, Doing Business As (DBA), publishing, and dissolution and withdrawal. |

| Document filing and retrieval | We help entities file initial and annual reports, offer drop-off filing services, and assist them in securing certificates of good standing and certified copies. |

South Carolina Charity Registration FAQs

This section provides answers to some of the most frequently asked questions about the South Carolina charitable registration process. For more details, visit Harbor Compliance’s Information Center.

Nonexempt nonprofits must file the Registration Statement for Charitable Organizations and the secretary of state’s Annual Financial Report and the IRS Form 990, 990-EZ, or 990-PF annually.

The SC charitable registrations must be renewed annually by the 15th day of the 5th month, following the close of an organization’s fiscal year. You can complete the process by filing the Registration Statement and financial report or the Application for Exemption.

No. Certain entities, such as public schools and veteran organizations with a congressional charter, qualify for an exemption and are not required to register in the state. However, they must file an Application for Exemption.

Partnering With Harbor Compliance for a Hassle-Free SC Charity Registration

Nonprofits in South Carolina must fulfill their charitable registration obligations by either registering or filing for an exemption with the secretary of state. Additionally, organizations must renew these filings annually to avoid penalties, protect their reputation, and maintain a strong donor relationship.

Balancing charitable registration with the demands of running a nonprofit, fundraising, and fulfilling your mission can be challenging. Fortunately, Harbor Compliance offers a streamlined solution that makes the entire process as smooth and effortless as possible. Order our Charitable Registration Service, and our representatives will reach out to guide you and do the heavy lifting.

You can also use our free Harbor Compliance Score™ to assess your organization’s standing with regulatory requirements in your state and contact us to explore other services that may improve your entity’s compliance. Additionally, you can book a demo session of our software to explore the available modules and discover additional ways we can assist your entity.

Want to learn more about charitable registration requirements and processes throughout the U.S.? Find more guides in the table below:

- Jump To:

- South Carolina Nonprofit & Fundraising Company Licenses

- South Carolina Individual Nonprofit & Fundraising Licenses

Company Licenses

South Carolina Nonprofit & Fundraising Company Licenses

South Carolina Bingo License

Initial Registration

| Agency: | South Carolina Department of Revenue - Bingo Licensing and Enforcement Unit |

| Form: | Form L-2058: Application for Bingo License Nonprofit Organization |

| Agency Fee: | $4,000 for Class AA license, $1,000 for Class B license, $0 for Class C license, $100 for no more than 10 days or $200 for more than 10 days for Class D license, $500 for Class E license, $100 for Class F license. |

South Carolina Charitable Gift Annuity Registration

Not required

Charitable Gift Annuity licensure is not required on the State level in South Carolina.

No filing is required, but charities need to meet certain conditions before issuing charitable gift annuities. South Carolina exempts charitable, religious, benevolent, and educational organizations from insurance laws related to charitable gift annuities as long as they have been in existence for at least 5 years. For-profit entities, including nursing homes, are not exempt.

| Law: | SC Code § 38-5-20 |

South Carolina Charitable Organization Registration

| Agency: | South Carolina Secretary of State - Division of Public Charities |

| Law: | |

| Foreign Qualification is Prerequisite: | No |

| Registered Agent (Special Agency) Required? | Yes |

Automatic Exemption

| Exemption Eligible Organizations: |

|

| Notes: | Religious organizations and political candidates and groups are automatically exempt from registration. |

Registration to Obtain Exemption

| Exemption Eligible Organizations: | Organizations that do not use professional solicitors, professional fundraising counsels, or commercial coventurers to solicit and meet one of the following criteria:

Also, organizations that meet one one of the following criteria regardless of whether or not they use professional solicitors, professional fundraising counsels, or commercial coventurers to solicit:

|

| Form: | |

| Agency Fee: | $0 |

| Law: |

Renewal to Maintain Exemption

| Exemption Eligible Organizations: | Organizations that do not use professional solicitors, professional fundraising counsels, or commercial coventurers to solicit and meet one of the following criteria:

Also, organizations that meet one one of the following criteria regardless of whether or not they use professional solicitors, professional fundraising counsels, or commercial coventurers to solicit:

|

| Form: | |

| Agency Fee: | $0 |

| Due: | Annually by the 15th day of the 5th month following the close of your fiscal year. |

Initial Registration

| Form: | |

| Filing Method: | Online or mail. |

| Agency Fee: | $50 + $1.85 online filing fee. |

| Turnaround: | 1 week |

| Original Ink: | Not Required |

| Notarization Required?: | Not Required |

| Notes: |

|

| Before you Apply: | Domestic Applicants:

Foreign Applicants:

|

| How to Apply: | Domestic Applicants:

Foreign Applicants:

|

| Required Attachments: |

|

Registration Renewal

Annual Registration Statement

| Form: | Registration Statement for a Charitable Organization (Renewal) |

| Filing Method: | Online or mail. |

| Agency Fee: | $50 + $1.85 online filing fee. |

| Due: | Annually by the 15th day of the 5th month following the close of your fiscal year. So if your fiscal year ends December 31, then file by May 15. |

| Due Date Extension: | The registration statement renewal cannot be extended. |

| Original Ink: | Not Required |

| Notarization Required?: | Not Required |

| Penalties: | $10 per day per delinquent report (max $2,000 per report) |

| Notes: |

|

| Required Attachments: |

|

Registration Renewal

Annual Financial Report

| Form: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $0 |

| Due: | Annually by the 15th day of the 5th month following the close of your fiscal year. So if your fiscal year ends December 31, then file by May 15. |

| Due Date Extension: | The due date for the annual financial statement can be extended for 6 months beyond the original due date by emailing the department at charities@sos.sc.gov with your request. |

| Original Ink: | Not Required |

| Notarization Required?: | Not Required |

| Penalties: | $10 per day per delinquent report (max $2,000 per report) |

| Notes: | Organizations who do not file by the due date will receive a notice by certified mail giving them 15 days to submit the required renewal before late fees begin to accrue. |

| Required Attachments: | None |

Contract Filing

| Form: | |

| Filing Method: | |

| Agency Fee: | $0 |

| Turnaround: | 1-2 business days |

| Due: | File a notice of solicitation at least 10 days prior to the start of each solicitation campaign. |

| Notes: | Contracts between charities and commercial coventurers must disclose the following, if applicable:

|

Reinstatement

Not required

Formal reinstatement is not required. Charities wishing to renew a lapsed registration should submit a renewal filing (registration statement and/or annual financial report) with payment of applicable fees (renewal + late fees). Organizations that have been out of compliance for an extended time should reach out to the Division directly for a detailed list of what they need to supply.

Change of Fiscal Year

| Filing Method: | Email charities@sos.sc.gov to update fiscal year. |

| Agency Fee: | $0 |

| Turnaround: | 1-2 business days |

| Notes: | Your fiscal year can be updated by emailing the secretary of state with notice of this change. Make sure to include the full name of the organization and charity registration ID. |

Cancelation

| Filing Method: | Email charities@sos.sc.gov |

| Agency Fee: | $0 |

| Notes: | To withdraw a registration you must email and termination request letter and make sure all annual financial reports are up to date to the last day of solicitations in South Carolina. |

Commercial co-venturer means a person that regularly and primarily engages in trade or commerce for profit that, for the benefit of a charitable organization, may raise funds by advertising that the purchase or use of goods, services, entertainment, or other thing of value benefits the charitable organization, if it is offered at a price comparable to similar goods or services in the market.

South Carolina Commercial Co-Venturer Registration

| Agency: | South Carolina Secretary of State - Division of Public Charities |

| Law: | |

| Registered Agent (Special Agency) Required? | Yes |

Initial Registration

| Form: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $50 |

| Turnaround: | 1-2 business days |

| Bond Amount: | None |

| Background Check Requirements: | ACCESS PREMIUM DATA |

Registration Renewal

| Form: | Registration Application for a Commercial Co-Venturer (Renewal) |

| Filing Method: | Mail or online. |

| Agency Fee: | $50 |

| Due: | Annually by date of issuance |

| Bond Amount: | None |

Contract Filing

| Form: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $0 |

| Due: | File a notice of solicitation at least 10 days prior to the start of each solicitation campaign. |

| Notes: | Contracts between charities and commercial coventurers must disclose the following, if applicable:

|

| How to Apply: | The charity must be registered to solicit charitable contributions or otherwise exempt for the contract to be accepted. |

Contract Amendment

| Agency Fee: | $0 |

| Due: | An amendment filing should be made before the expiration date of a campaign in order to extend the campaign. |

| Notes: | To report an extension of a campaign or another change to a campaign agreement, submit a cover letter describing the change and include a copy of the amended agreement. |

Financial Reporting

| Form: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $0 |

| Due: | Within 90 days after a campaign has ended and within 90 days after the anniversary of commencement for campaigns lasting more than a year. |

| Penalties: | South Carolina enforces very strict fines on joint financial reports that are not filed within 90 days of the conclusion of the campaign. |

Professional fundraising counsel means a person that for a fixed rate of compensation plans, conducts, manages, prepares materials for, advises, or acts as a consultant, directly or indirectly, in connection with soliciting contributions for or on behalf of a charitable organization, but that actually does not solicit, receive, or collect contributions as a part of these services. A person whose compensation is computed on the basis of funds actually raised or to be raised is not a professional fundraising counsel pursuant to the provisions of this chapter. A bona fide salaried officer or employee of a charitable organization maintaining a permanent establishment within this State, or the bona fide salaried officer or employee of a parent organization certified as tax exempt, is not a professional fundraising counsel.

South Carolina Professional Fundraising Counsel Registration

| Agency: | South Carolina Secretary of State - Division of Public Charities |

| Law: | |

| Registered Agent (Special Agency) Required? | Yes |

Initial Registration

| Form: | Registration Application for a Professional Fundraising Counsel |

| Agency Fee: | $50 |

Registration Renewal

| Form: | Registration Application for a Professional Fundraising Counsel (Renewal) |

| Agency Fee: | $50 |

| Due: | Annually |

Contract Filing

| Form: | |

| Agency Fee: | $0 |

| Due: | File a notice of solicitation at least 10 days prior to the start of each solicitation campaign. |

| Notes: | Contracts between charities and professional fundraising counsel must disclose the following, if applicable:

|

Professional solicitor means a person that, for monetary or other consideration, solicits contributions for or on behalf of a charitable organization, either personally or through its agents, servants, or employees or through agents, servants, or employees who are specially employed by or for a charitable organization, who are engaged in the solicitation of contributions under the direction of that person. "Professional solicitor" also means a person that plans, conducts, manages, carries on, advises, or acts as a consultant to a charitable organization in connection with the solicitation of contributions but does not qualify as "professional fundraising counsel" within the meaning of this chapter. A bona fide salaried officer, unpaid director, a bona fide employee of a charitable organization, or a part-time student employee of an educational institution is not a professional solicitor. A paid director or employee of a charitable organization is not a professional solicitor unless his salary or other compensation is paid as a commission computed on the basis of funds actually raised or to be raised.

South Carolina Professional Fundraising Solicitor Registration

| Agency: | South Carolina Secretary of State - Division of Public Charities |

| Law: | |

| Bond Requirements: | $15,000 |

Initial Registration

| Form: | |

| Agency Fee: | $50 |

| Original Ink: | Not Required |

| Notarization Required?: | Not Required |

| Notes: |

|

| Before you Apply: |

|

| Required Attachments: |

|

Registration Renewal

| Form: | Registration Application for a Professional Solicitor (Renewal) |

| Agency Fee: | $50 |

| Due: | Annually |

| Original Ink: | Not Required |

| Notarization Required?: | Not Required |

Contract Filing

| Form: | |

| Agency Fee: | $0 |

| Due: | File a notice of solicitation at least 10 days prior to the start of each solicitation campaign. |

| Notes: | Contracts between charities and professional solicitors must disclose the following, if applicable:

|

Financial Reporting

| Form: | |

| Agency Fee: | $0 |

| Due: | Within 90 days after a campaign has ended and within 90 days after the anniversary of commencement for campaigns lasting more than a year. |

Individual Licenses

South Carolina Individual Nonprofit & Fundraising Licenses

South Carolina Individual Professional Solicitor Registration

| Agency: | South Carolina Secretary of State - Division of Public Charities |

Initial Registration

| Form: | Registration Application for an Individual Professional Solicitor |

| Agency Fee: | $50 |

| Original Ink: | Not Required |

| Notarization Required?: | Not Required |

Registration Renewal

| Form: | Registration Application for an Individual Professional Solicitor (Renewal) |

| Agency Fee: | $50 |

| Due: | Annually |

| Original Ink: | Not Required |

| Notarization Required?: | Not Required |

![Save Resources with Expertly Managed Fundraising Compliance{{ include_custom_fonts({"Museo Sans":["Bold","Bold Italic","Regular","Regular Italic"]}) }}](https://no-cache.hubspot.com/cta/default/560178/interactive-191349133086.png)

![Harbor Compliance has combined with Labyrinth, Inc., the largest provider of charitable registration services in the country.{{ include_custom_fonts({"Museo Sans":["Bold","Bold Italic","Regular","Regular Italic"]}) }}](https://no-cache.hubspot.com/cta/default/560178/interactive-191348300707.png)

![Easily Earn Your License to Fundraise{{ include_custom_fonts({"Museo Sans":["Bold","Bold Italic","Regular","Regular Italic"]}) }}](https://no-cache.hubspot.com/cta/default/560178/interactive-191347712296.png)