Rhode Island Fundraising Licensing

Below, you'll find licensing requirements for a range of fundraising activities. At a glance, you can see requirements, fees, filing instructions, and links to forms for everything from charitable gaming and cause marketing to professional fundraisers and charitable gift annuities.

Make sure your fundraising activities meet the unique requirements of each jurisdiction where you’re soliciting. Feel free to explore, bookmark, and share!

- Jump To:

- Rhode Island Nonprofit & Fundraising Company Licenses

- Rhode Island Individual Nonprofit & Fundraising Licenses

Company Licenses

Rhode Island Nonprofit & Fundraising Company Licenses

Rhode Island Bingo License

| Game Type: | Bingo |

| Agency: | Rhode Island Division of State Police - Charitable Gaming Unit |

| Organization Age Requirement: | 2 years of continuous existence in Rhode Island immediately preceeding licensure. |

Initial Registration

| Agency: | Rhode Island Division of State Police - Charitable Gaming Unit |

| Form: | |

| Agency Fee: | $5 |

Rhode Island Charitable Gift Annuity Registration

Not required

Charitable Gift Annuity licensure is not required on the State level in Rhode Island.

Rhode Island statutes do not address charitable gift annuities, but division of insurance rules exempt charitable organizations from disclosure rules that apply to other entities.

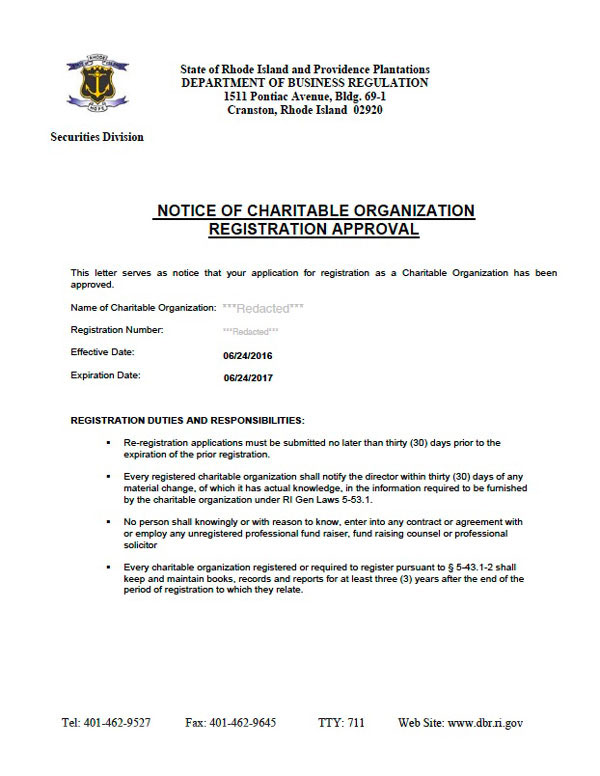

Rhode Island Charitable Organization Registration

| Agency: | Rhode Island Department of Business Regulation - Securities Division - Charities Section |

| Law: | |

| Foreign Qualification is Prerequisite: | No |

| Registered Agent (Special Agency) Required? | No |

Automatic Exemption

| Exemption Eligible Organizations: |

|

| Law: | |

| Notes: | Charities must register within 30 days if they exceed $25,000 in contributions. |

Initial Registration

| Filing Method: | |

| Agency Fee: | $90 filing fee + $3.98 online filing fee. |

| Turnaround: | 2-3 weeks |

| Original Ink: | Not Required |

| Notarization Required?: | Not Required |

| Notes: |

|

| Before you Apply: | Domestic Applicants:

Foreign Applicants:

|

| How to Apply: | Domestic Applicants:

Foreign Applicants:

|

| Required Attachments: |

|

Registration Renewal

| Filing Method: | |

| Agency Fee: | $90 filing fee + $3.98 online filing fee. |

| Due: | Annually by the registration anniversary date. |

| Due Date Extension: | Due dates can be extended for 6 months beyond the original due date by submitting either IRS form 8868 or a letter requesting an extension. |

| Original Ink: | Not Required |

| Notarization Required?: | Not Required |

| Penalties: |

|

| Notes: |

|

| Required Attachments: |

|

Reinstatement

Not required

Reinstatements are handled on a case-by-case basis. If a charity has been out of compliance for less than 5 years, they should submit a single renewal filing, financial documents for every year not registered, and all applicable fees (renewal + late fees). Registrations expired for more than 5 years also require the charity to submit an initial filing. Charities MUST call the division directly to facilitate the renewal of a registration that has been expired for more than 5 years.

Change of Fiscal Year

| Agency Fee: | $0 |

| Notes: | An organization's fiscal year can updated during the standard renewal process. |

Cancelation

| Filing Method: | Email to DBR.CharityInquiry@dbr.ri.gov |

| Agency Fee: | $0 |

| Notes: | To close out your registration, submit a letter requesting a withdrawal. Evidence must be provided to substantiate the claim that solicitations are longer taking place in Rhode Island. |

Rhode Island Commercial Co-Venturer Registration

Not required

Commercial Co-venturer licensure is not required on the State level in Rhode Island.

Rhode Island does not currently have a traditional registration requirement for commercial co-venturers, but they may need to follow other regulations before and after fundraising events.

"Fundraising counsel" means any person who for compensation consults with a charitable organization or who plans, manages, advises, or assists with respect to the solicitation of contributions for or on behalf of a charitable organization, but who does not have access to contributions or other receipts from a solicitation and who does not solicit. Bona fide volunteers or employees of a charitable organization, or an attorney-at-law retained by a charitable organization, shall not be deemed a fundraising counsel.

Rhode Island Fundraising Counsel Registration

| Agency: | Rhode Island Department of Business Regulation - Securities Division - Charities Section |

| Law: |

Initial Registration

| Filing Method: | |

| Agency Fee: | $240 |

Registration Renewal

| Filing Method: | |

| Agency Fee: | $240 |

| Due: | Annually by June 30. |

Contract Filing

| Agency Fee: | $0 |

| Due: | Copies of all contracts with charitable organizations must be submitted within 10 days after signing. |

"Professional fundraiser" means any person who directly or indirectly for compensation or other consideration plans, manages, conducts, carries on, or assists in connection with a solicitation for charitable purposes or individually solicits or who or that employs or otherwise engages on any basis another person to solicit for or on behalf of any charitable organization, or who or that engages in the business of, or holds himself, herself, or itself out to persons as independently engaged in the business of soliciting for the charitable purpose. Bona fide volunteers or employees of a charitable organization or fundraising counsel shall not be deemed a professional fundraiser.

Rhode Island Professional Fundraiser Registration

| Agency: | Rhode Island Department of Business Regulation - Securities Division - Charities Section |

| Law: | |

| Bond Requirements: | $10,000 |

Initial Registration

| Filing Method: | |

| Agency Fee: | $240 |

| Original Ink: | Not Required |

| Notarization Required?: | Not Required |

| Notes: | A copy of all contracts with charitable organizations must be submitted with the application. |

| Before you Apply: |

|

| Required Attachments: |

|

Registration Renewal

| Filing Method: | |

| Agency Fee: | $240 |

| Due: | Annually by June 30. |

| Original Ink: | Not Required |

| Notarization Required?: | Not Required |

Contract Filing

| Agency Fee: | $0 |

| Due: | Copies of all contracts with charitable organizations must be submitted within 10 days after signing. |

Rhode Island Raffle License

| Game Type: | Raffles |

| Agency: | Rhode Island Division of State Police - Charitable Gaming Unit |

| Law: | RI Stat. § 11-19-31 et seq. |

Rhode Island Senior Citizen's Bingo License

| Game Type: | Bingo |

| Agency: | Rhode Island Division of State Police - Charitable Gaming Unit |

| Age Restrictions: | Participants must be 55 or older. |

| Prize Limits: | The maximum aggregate daily prize is $400. |

Individual Licenses

Rhode Island Individual Nonprofit & Fundraising Licenses

Rhode Island Individual Professional Fundraiser Registration

| Agency: | Rhode Island Department of Business Regulation - Securities Division - Charities Section |

Initial Registration

| Filing Method: | |

| Agency Fee: | $0 |

| Original Ink: | Not Required |

| Notarization Required?: | Not Required |

Registration Renewal

| Filing Method: | |

| Agency Fee: | $0 |

| Due: | Annually by June 30. |

| Original Ink: | Not Required |

| Notarization Required?: | Not Required |