How to Start Your Business

Overview

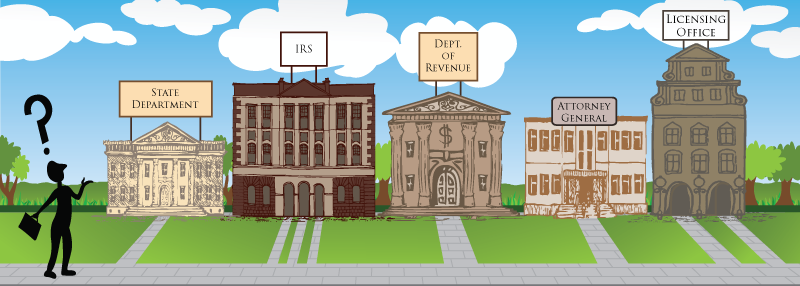

This guide is about the government paperwork to open your business. This guide will introduce you to the process of registering your business with state and federal governments. This maze of incorporation, licensing, and taxation can be daunting to new business owners. But don't worry, this guide will help you step by step.

Is This You?

You know you want to start your business. And you know that you need to:

- File your business name

- Form an LLC or corporation (maybe)

- Get a federal tax ID from the IRS

- Get state and local tax IDs

- Get business licenses (maybe)

- Set up your business records

- Open a business bank account

- ... and probably some other things too...

But what paperwork do you actually file with which agencies? And in what order?! The answer to these questions is the heart of this guide. We will tell you exactly what paperwork needs to be filed with which agencies, and the correct order of filing documents. We'll also provide the total cost and the total timeline across all agencies before you start filing.

State-Specific Instructions

Did you know the rules to create and run a compliant LLC, corporation, or other business structure are different in every state? We have offices in all 50 states and work hard to bring you the local knowledge you won't find anywhere else.

If there was one disease we could cure in our industry, it would be national one-size-fits-all misinformation. So many laws, processes, and forms depend on in which state you're starting your business.

Instead of national generalizations, this guide gives you real answers to your burning business questions: "what's required", "how much", "how long", and "how to".

Consequently, the vast majority of this guide is organized into state-specific pages. That's why you'll only need to read a fraction of our 200+ pages.

Keeping Up With Government Changes

Every year state legislatures pass changes to their business code. Government agencies update their forms, processes, and fees to enact these changes. On top of that, many agencies are in the process of migrating from paper forms to online.

You'll see a last fact-checked date on every page of this guide. We do our very best to keep our information current, and that's part of why we wrote an online guide as opposed to a downloadable pdf or physical book. This information changes all the time; this way we can update it, and you can get the most recent information without buying another book!

All right, Time to Dive In!

Click on your state in the map below to navigate to step-by-step instructions for your state and your business structure. You'll see the paperwork, time, cost and step-by-step instructions to get set up:

Staying Compliant

If you thought the process of registering a business was a wild enough ride through government paperwork, brace yourself for the ongoing maintenance of running a compliant business entity. Check out our Business Compliance Guide next!

| State to Start Your Business | Helpful Resources |

|---|---|

|

Alabama |

|

|

Alaska |

|

|

Arizona |

|

|

Arkansas |

|

|

California |

|

|

Colorado |

|

|

Connecticut |

|

|

Delaware |

|

|

Florida |

|

|

Georgia |

|

|

Hawaii |

|

|

Idaho |

|

|

Illinois |

|

|

Indiana |

|

|

Iowa |

|

|

Kansas |

|

|

Kentucky |

|

|

Louisiana |

|

|

Maine |

|

|

Maryland |

|

|

Massachusetts |

|

|

Michigan |

|

|

Minnesota |

|

|

Mississippi |

|

|

Missouri |

|

|

Montana |

|

|

Nebraska |

|

|

Nevada |

|

|

New Hampshire |

|

|

New Jersey |

|

|

New Mexico |

|

|

New York |

|

|

North Carolina |

|

|

North Dakota |

|

|

Ohio |

|

|

Oklahoma |

|

|

Oregon |

|

|

Pennsylvania |

|

|

Rhode Island |

|

|

South Carolina |

|

|

South Dakota |

|

|

Tennessee |

|

|

Texas |

|

|

Utah |

|

|

Vermont |

|

|

Virginia |

|

|

Washington |

|

|

West Virginia |

|

|

Wisconsin |

|

|

Wyoming |

|