50-State Sales Tax Compliance Guide

Sales tax regulations are more complex than ever before. Businesses now face registration and reporting requirements in states where they don't necessarily have a physical presence. Read about state rules governing sales taxable activity and how to register for sales tax.

Overview

Businesses making physical and online sales face a complex landscape of requirements. Each state has its own rules establishing what products are taxable, what constitutes nexus, and when registration is necessary. While the landmark ruling in South Dakota vs. Wayfair, Inc. increased states’ ability to collect taxes on online sales, the COVID-19 pandemic has only furthered online sales activity itself. This means most businesses face exposure to state sales tax requirements like never before.

This guide provides an overview of state sales tax compliance. The goal is to help you assess your exposure and take steps to mitigate risk through registration and other activities.

Definitions

Throughout this guide, you will encounter several important terms:

- Sales tax is tax on the consumption of goods or services, most often levied to the final purchaser at the time of sale. Contrary to popular belief, sales tax is not limited to retail sales. Services, leases, rentals, online sales, and other transactions can be subject to sales tax, as defined by the taxing authority. Sales tax can be levied simultaneously by state, county, and municipal agencies, so the final sales tax charged is the sum of these rates.

- Use tax goes hand-in-hand with sales tax. Use tax is a consumption tax imposed on the consumer for out-of-state tangible personal property that is used, consumed, or stored in the state. Use taxes are self-assessed. Typically applications for sales tax ids and use tax ids are consolidated into one form.

- Nexus is the technical term for when an organization has legal obligations to collect and remit sales tax in a given state. The burden of collecting sales tax is on the seller and not the buyer, which means that businesses and nonprofits are responsible for which geographies and transactions they are required to collect tax.

- Nexus can be either physical (resulting from a direct presence in a state) or economic (based on activity reaching customers of a state). Businesses must understand how different activities may create both types of nexus, even within a single jurisdiction. The result is increased monitoring and potentially registration for one or more tax types.

- A marketplace facilitator is an online marketplace (such as Amazon, Walmart, Etsy, and eBay) that lists, collects payment for, and fulfills orders on behalf of a third-party seller. Today, most states require marketplace facilitators to register, collect, and remit marketplace facilitator tax and handle reporting on behalf of individual sellers.

- Businesses must understand the difference between selling through a marketplace facilitator and selling to customers directly (see “Remote Seller”).

- A remote seller is any person or business making sales into any state outside of their home state that does not have physical nexus in those states. This definition applies to any eCommerce seller that sells products from their own website or selling platform and ships them into other states. Remote sellers must be aware of when and where they trigger economic nexus and must collect and remit sales tax (Remote Seller Tax) to each nexus state to remain compliant.

- Businesses must understand the difference between remote sales it makes through independent channels and those made on a marketplace (see “Marketplace Facilitator”).

What Are the Sales Tax Compliance Requirements?

Businesses are generally required to collect and remit sales tax once their activity reaches a certain number or dollar amount of sales in a state. The exact thresholds vary by state, the products or services sold, and the method by which sales are made. Once the business reaches the threshold in a given state, it is generally required to register for a sales tax account. Depending on the type of nexus created, the business may need to register for sales tax, remote seller tax, and income or franchise tax.

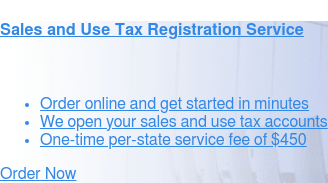

Sales tax registration is an important and time consuming process. Learn how to register for sales and use tax in our handy state-specific guide.

Where Does a Business Have Exposure to Sales Tax Requirements?

Where a business has exposure to sales tax primarily depends on what it sells, where it sells it, and how much of it is sold. For example, a brick and mortar business selling products to local customers may only need to collect sales tax in their state, while a fast-growth technology company may need to collect sales tax nationwide.

Modern businesses use a combination of physical and online channels to reach customers. Every state taxes products, services, and software differently. Depending on the business, it may decide to sell strategically to customers in additional states, or its sales may quickly reach all states. All of these factors create exposure and possible risk. Keep reading to learn how to assess your risk and take action.

How Does a Business Comply with Sales Tax Requirements?

To comply with sales tax requirements, businesses must begin monitoring their sales to each state, opening applicable sales tax accounts, and tracking and collecting sales tax.

Businesses are required to comply with all secretary of state, tax, and licensing requirements where it operates. Sales tax compliance is no exception. While every business has different levels of exposure, it can take proactive steps to:

- Identify every state where their business has sales tax nexus.

- Register in every state where their business triggers nexus.

- Accurately calculate sales tax on every applicable transaction.

- Collect and securely storing tax monies until business taxes are filed.

- Correctly report sales tax in applicable states on a predefined filing schedule.

- Remit tax payment to every state where nexus has been triggered.

All businesses, but especially those selling online and to customers in multiple states, must adopt a proactive strategy to monitor, register, and report. Thankfully, businesses have a network of advisors, service companies, and technologies to guide them.

How to Assess Your Business’s Exposure to Sales Tax Requirements

Assessing your business's exposure to sales tax requirements means looking closely at what you sell, where you sell it, and in what amount. Determining nexus and associated sales tax obligations can be challenging to navigate on your own. LumaTax can help. Their free assessment makes it easy to determine where you’ve most likely triggered physical and economic nexus.

- Answer seven simple questions to assess your risk

- Receive your LumaTax Compliance Score™ in minutes

- Get expert advice on next steps towards compliance