-

Software

Compliance Software

Oversee licenses, track renewals, access documents, and more from a single interface.

Software Overview -

Services

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

Services Overview -

Industries

-

Partner

- Information Center

Categorized Under

Business Compliance

Ready, Set, Hire! An Overview of Legal Issues in the Hiring Process for Businesses (Part 3 of 6)

Posted on November 24, 2014, by in Business Compliance, Industry News.

Last week, we tackled the issues of mandatory insurance for employers and compliance posters in the workplace. This week, we will navigate the complicated and often shark-infested legal waters of post offer, pre-employment physical examinations.

Where the Problem Arises

The … Read more

Ready, Set, Hire: An Overview of Legal Issues in the Hiring Process for Businesses (Part 2 of 6)

Posted on November 14, 2014, by in Business Compliance, Industry News.

During the last blog entry, I discussed the first two issues that employers are likely to face in the hiring process: job postings and interviews. This week, continuing with the theme chronologically, we will tackle issues involving insurance and … Read more

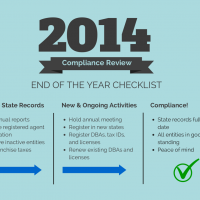

End of the Year Compliance for Small Businesses

Posted on November 10, 2014, by in Business Compliance.

The end of the year is the ideal time to review compliance for your business. For many businesses, this is a time to “catch up” on compliance activities for the year and prepare for next year. Filings also may … Read more

Ready, Set, Hire: An Overview of Legal Issues in the Hiring Process for Businesses (Part 1 of 6)

Posted on November 4, 2014, by in Business Compliance, Industry News.

So, you are ready to hire a new employee to supplement your growing business. This is certainly an exciting time for you and your business. However, as you may already be aware, hiring an employee presents a variety of potential … Read more

This Halloween, Dress Your Business for Success

Posted on October 29, 2014, by in Business Compliance.

There’s nothing scarier to a small business owner than to find her business does not have adequate liability protection, because she hasn’t properly registered her business with the state.

However, there are thousands, if not millions of solopreneurs, freelancers, and … Read more

Understanding Electronic Filing in Your State

Posted on October 23, 2014, by in Business Compliance, Industry News.

Many states offer electronic filing options for business registration. As more states finally move into the 21st century (half-joking, of course), online filing will become the norm, and mailing a filing will become a thing of the past.

As you … Read more

Online Filing Now Available in Pennsylvania

Posted on October 9, 2014, by in Business Compliance, Industry News.

Beginning October 8th, the Pennsylvania Department of State is launching online filing services for Pennsylvania professional license holders, corporations, and other business entities.

Businesses incorporating in Pennsylvania, and those obtaining business licenses, can use the online filing service in … Read more

3 Ways Your Business Structure Affects Your Startup Marketing Strategy

Posted on September 29, 2014, by in Business Compliance.

Did you know the business structure you select, and the business name you register, affects your startup marketing strategy?

We’ve already discussed the steps required to choose and to register your business name. Once you’ve decided, it will affect your … Read more

5 Reasons to Use a National Registered Agent

Posted on September 23, 2014, by in Business Compliance, Registered Agent.

As you expand your business into new states, it is important to have a national registered agent provider for each state you register in. Just as managing operating expenses and estimating ROI is important, hiring a single registered agent company across multiple … Read more

Harrisburg Startup Weekend

Posted on September 17, 2014, by in Business Compliance.

Harrisburg Startup Weekend is rapidly approaching!

September 29th, 2014 marks the beginning of Harrisburg Startup Week, seven days dedicated to the passion and development of entrepreneurship in Central Pennsylvania.

The final three days of the week, October 3-5, are … Read more