501(c) Application

We prepare and file your government paperwork for your nonprofit to apply for 501(c) federal tax exemption.

- Save money on federal income taxes

- Raise more funds as donors make tax-deductible contributions

- Gain added credibility

501(c) is a section of the Internal Revenue Service tax code that provides tax exemptions for certain public charities, private foundations, and other nonprofit organizations. Your IRS Determination Letter on tax-exempt status also indicates if donors may give tax-deductible donations. We help your organization obtain 501(c) tax-exemption.

3 Easy Steps

What to Expect

Applying for 501(c) deserves its reputation for being complex, but we help you every step of the way.

To begin:- Based on our own experience, we’ll let you know if your organization will likely qualify

- We’ll confirm if your organization will need to pay the $400 or $850 IRS application fee

- We’ll request and conduct a preliminary review of your supporting paperwork such as financial statements. We’ll let you know of other work that will need to be done such as an amendment to your articles of incorporation if they contain insufficient provisions.

- We will prepare your Form 1023 or 1024 and application package

- Our service includes a review with an accountant for your peace of mind.

- We provide instructions for submitting your completed application and user fee to the IRS.

Save Time

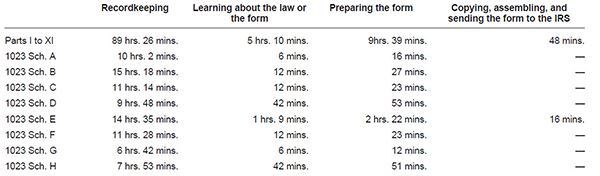

The IRS estimates Form 1023 can take 90+ hours to file. Order with us and we’ll take the driver’s seat.

1-on-1 Support

Your dedicated nonprofit specialist handles your application from start to finish.

Responsive

We respond to your communications in 1 business day and prepare your 501(c) application promptly.

Specialized Expertise

Our entire business is small business incorporation and compliance.

We take the security of your sensitive information seriously. During the course of your 501(c)(3) application we will need to collect personal data, financial statements, and company records. Your filing specialist is a screened U.S. citizen working in our U.S. headquarters.