Pennsylvania Tax ID

Our Pennsylvania Tax ID service registers your business for state taxes.

- Fulfill your obligation to register your business for state tax accounts

- Obtain your PA state tax IDs (one per tax account)

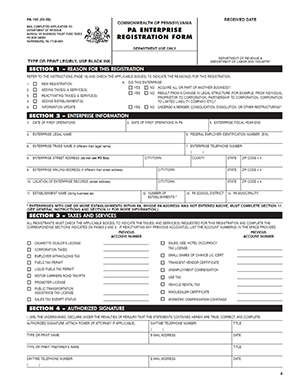

Our service prepares and files your PA-100 form to register your business for Pennsylvania business tax accounts. You will receive your Pennsylvania Tax ID(s) over the following 24hours - 4 weeks.

- Tell us the tax accounts desired.

- We prepare and file form PA-100 to register your business for these tax accounts.

- Receive your Pennsylvania Tax ID(s) in 2-4 weeks

What is a Pennsylvania Tax ID?

In Pennsylvania, your business does not have a single tax id, but rather an account number (also known as box number) for each tax account with the Pennsylvania Department of State.

For example, if your business sells candy bars and has employees, you will have separate tax accounts

with the Pennsylvania Department of Revenue for sales tax and employer withholding tax.

List of Pennsylvania Tax IDs (Pennsylvania Business Tax Accounts):

Except for the two accounts indicated, the remaining tax accounts are created by filing PA-100 with the Pennsylvania Department of Revenue.

Pennsylvania Tax ID vs. Federal Tax ID

Your Pennsylvania business obtains separate tax IDs to be used for federal and state taxes. Learn about federal tax identification numbers (TIN, fTIN, EIN, and fEIN). If you are applying for Pennsylvania Tax ID(s), you may also need to apply for a Federal Tax ID. For example, when your business hires its first W-2 employee, this necessitates registering for both IDs if you have not done so already.

How Pennsylvania Tax IDs are Issued

Is your business an LLC, corporation, or other business entityBusiness entities include LLC, corporation (C-Corp, S-Corp, nonprofit), and various limited partnerships. Sole proprietorships and general partnerships are not legal entities, separate from their owners.?

If so, then you will automatically receive your first Pennsylvania business tax account when you form or

register your business entity with the Pennsylvania Department of State. Your registration is

automatically relayed to the Pennsylvania Department of Revenue, who will register your business for

capital stock, corporate net income, and loans tax. The Department of Revenue then mails you the tax

account number and information about your tax responsibilities within 3-4 weeks.

But that isn’t the end of the story. All Pennsylvania businesses are responsible for registering for applicable state tax accounts with the Pennsylvania Department of Revenue.

There are over 15 business state taxes - the most common taxes are sales tax and employer-related taxes.

This registration is accomplished by filing form

PA-100 with the Pennsylvania Department of Revenue.

Continue reading “Do You Need to File PA-100” for guidance on the most common reasons

businesses need to register for additional state tax accounts.

Fulfill Your Registration Responsibilities

Our service registers your business for required state tax accounts.

Do You Need to File Form PA-100?

The PA-100 Business Tax Registration Form is used by new businesses to register for their initial

applicable state tax accounts and by existing businesses to register for additional taxes.

If any of the following are topical to your business, you may have a state tax obligation and

therefore need to file PA-100 to register.

Sales tax account(s):

- Sales Tax

- Local Sales Tax (for sales in Philadelphia and Allegheny Counties)

- Hotel Occupancy Tax

Employer tax account(s):

- Employer Withholding Tax

- Unemployment Compensation

- Workers' Compensation Coverage

Wholesaler (reseller) tax account(s):

- Wholesaler Certificate

Use tax account(s):

- Use Tax

Specific products, services, or activities:

- Malt Beverage and Liquor Tax

- Cigarette License / Tax

- Small Games of Chance

- Liquid Fuels and Fuels Tax

- Motor Carriers Road Tax

- Financial Institution Taxes

- Promoter License

- Transient Vendor Certificate

- Gross Premium Tax (applicable to insurance companies)

- Public Transportation Assistance Tax

Tip: While the PA-100 discusses obtaining a “Certificate of Exempt Sales Tax” (for example, if you are a charitable organization), filing PA-100 is an unnecessary intermediate step.

Jump to REV-72

Tip: Corporations, LLCs, and other business entities will be automatically registered for corporate taxes (capital stock, corporate net income, and loans tax) when they form their entity or complete their foreign registration with the Pennsylvania Department of State.

Our Service & Pricing

Our service obtains your Pennsylvania Tax ID(s). We prepare and file your 14-page PA-100 form for you. You receive your Pennsylvania Tax ID(s) in 2-4 weeks depending on the type of tax accounts required. Please contact us for pricing

Identify applicable tax accounts

- Tell us the tax accounts you would like registered.

We prepare and file Form PA-100 (14 pages)

- We are fast and complete our work to prepare your form

- Review and sign your form before it is submitted to any government agency

Receive your Pennsylvania Tax ID(s) in 2-4 weeks

- We submit your form to the Pennsylvania Department of Revenue

- State processing times vary from 24 hours to 4 weeks depending on the tax accounts being set up. Please allow 2-4 weeks to receive all accounts.

It can take 4 weeks to file... Start Today!

We do our work in one business day, but please allow up to 4 weeks to receive all tax accounts.