-

Software

Compliance Software

Oversee licenses, track renewals, access documents, and more from a single interface.

Software Overview -

Services

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

Services Overview -

Industries

-

Partner

- Information Center

Categorized Under

form 990

Get Ready for 990 and Fundraising Registration Renewals Due May 15!

Posted on April 12, 2019, by in Nonprofit Compliance.

May 15 is a big deadline for charitable solicitation registration renewals and IRS Form 990 filings. For nonprofits operating on a calendar tax year, Form 990 is due May 15. Currently, 13 states also require those organizations to file their … Read more

How Technology Enhances the IRS Form 990 Filing Process

Posted on September 24, 2018, by in Nonprofit Compliance.

Traditional paper filing for Form 990 can take hours to complete – fortunately, modern technology has provided a simplified e-filing process for exempt and nonprofit organizations to save time, securely file taxes online, and transmit nonprofit tax returns directly to … Read more

Six Things to Do Once Your Nonprofit Has Registered for Fundraising

Posted on June 25, 2018, by in Nonprofit Compliance.

If your organization has invested in meeting all of your state charitable registration requirements, congratulations! By simply registering, you’ve already demonstrated your commitment to transparency in the nonprofit sector and accountability to your donors. You may, however, still be wondering … Read more

Coordinating 990s and Fundraising Registrations

Posted on April 23, 2018, by in Fundraising and Grants, Nonprofit Compliance.

Most state charitable solicitation registration renewals are due in some relation to the IRS Form 990 deadline. Because a copy of Form 990 is required in nearly every state to renew, aligning the deadlines makes sense, at least theoretically.

Organizations, … Read more

Summertime Slowdown? Not for Fundraising Compliance!

Posted on June 27, 2017, by in Fundraising and Grants, Industry News, Nonprofit Compliance.

As summer temps soar, financial reporting and renewal requirements are turning up the heat even more!

Don’t let charitable solicitation registration renewals and fiscal year-end financial prep put … Read more

IRS Form 990 due May 15, 2017

Posted on March 22, 2017, by in Industry News, Nonprofit Compliance.

Important Compliance Deadline for Nonprofits: Form 990 is due on 5/15/2017

For nonprofits on a calendar tax year, the annual 990 return is due May 15, 2017. You must file this return in order to keep your organization’s federal tax … Read more

New Law Streamlining Form 990 Extensions Comes into Effect

Posted on February 21, 2017, by in Industry News, Nonprofit Compliance.

Nonprofits rejoice! The long-awaited streamlining of Form 990 extensions will finally come into effect for the 2016 tax year (i.e. tax years beginning January 1, 2016). Form 990 tax returns are due four and a half months after the exempt … Read more

November 15 Filing Deadline for Charities

Posted on November 9, 2016, by in Fundraising and Grants, Industry News, Nonprofit Compliance.

November 15 is an important date for renewing charitable solicitation registrations. Many states base their charitable solicitation renewal and annual financial reporting due dates on the charity’s fiscal year. Upon filing with the state charitable solicitation authorities, charities must usually … Read more

IRS Form 990 Due May 15, 2015

Posted on April 17, 2015, by in Industry News, Nonprofit Compliance.

Important Compliance Deadline for Nonprofits: Form 990 is due on 5/15/2015

For nonprofits on a calendar tax year, your annual 990 filing is due May 15, 2015. This applies to most nonprofits.

Organizations not on a calendar tax … Read more

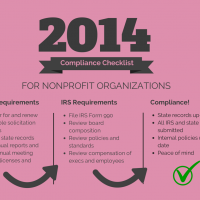

End of the Year Compliance for Nonprofits

Posted on November 19, 2014, by in Nonprofit Compliance.

In my previous post, I discussed end of the year compliance activities for small businesses. Running a nonprofit is a different animal altogether. Typically, nonprofit organizations have many more ongoing responsibilities.

Failure to keep up with compliance activities can … Read more