-

Software

Compliance Software

Oversee licenses, track renewals, access documents, and more from a single interface.

Software Overview -

Services

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

Services Overview -

Industries

-

Partner

- Information Center

New York Creates Additional Reporting Requirements for Soliciting Nonprofit Organizations

Update for November 12, 2021: New York Gov. Hochul has signed S4817a/A1141a, which repeals the redundant Department of State filing requirement.

Effective January 1, 2021, many nonprofit organizations that register with the New York Attorney General – Charities Bureau will now have to file the same annual documents with the New York Department of State (DOS). Because the DOS deadline aligns with the organization’s tax year end, many organizations must file on or before May 15, 2021.

These changes, resulting from Executive Law 172-B, create an additional reporting obligation for nonprofits that solicit charitable contributions in New York State (NYS). Changes to Executive Law 172-E and 172-F create additional reporting obligations for activity relating to 501(c)(4) organizations. Beginning July 1, 2021, new thresholds for audited financial statements will take effect.

Read on to learn about the full scope of changes and how it may impact your organization.

Which Organizations Are Impacted by the Executive Law 172-B Change?

Generally, organizations that meet all three of the following criteria must now file with the Department of State:

- Registers with the Attorney General to solicit charitable contributions.

- Files Form CHAR500 annually with the Attorney General.

- Has total revenue and support exceeding $250,000.

As a result, the changes put in place by Executive Law 172-B primarily impact larger nonprofit organizations. These changes apply to both in-state and out-of-state organizations.

Note: Organizations that are unsure if they need to register to solicit in New York or whether Executive Law 172-B applies to them should contact their attorney for guidance.

What Has Changed Under Executive Law 172-B?

Department of State Requires Separate, Additional CHAR500 Filing

Many organizations that file Form CHAR500 with the Attorney General must now file the same information with the New York Department of State.

Currently, the agencies do not share information between themselves. Organizations must now file both on the Attorney General filing portal and again on the Department of State filing portal. With each agency, organizations can expect to submit:

- A separate Form CHAR500 containing the same information

- Form 990 and all required schedules for the most recently completed tax year

- Audited financial statements for the most recently completed tax year

- Separate, applicable filing fees

The Department of State filing fee is $25 for all organizations. Currently, credit card payment is not available. Applicants must mail payment following the submission of their online application.

The Department of State CHAR500 filing’s due date is the same as the Attorney General’s due date. Organizations must file within four months and 15 days after the close of their tax year. For example:

- Organizations with a tax year ending December 31, 2020, have a due date of May 15, 2021.

- Organizations with a tax year ending June 30, 2021, have a filing deadline of November 15, 2021.

Currently, the Executive Law does not authorize the Department of State to grant extensions for reports filed with the Department. However, the statute also does not authorize the Department of State to impose any penalties for noncompliance with the filing requirements. The Department will accept reports submitted for filing after the report’s due date.

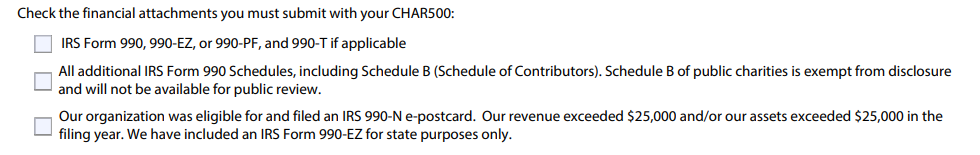

Addressing Questions About IRS Schedule B

Initially, this law change raised significant questions about IRS Schedule B, specifically how the Department of State would work to ensure donor privacy.

For context, the NYS Attorney General requires organizations to submit an unredacted version of Schedule B if it files one with the IRS. Notably, Attorney General Form CHAR500 reassures filers that this information is not subject to public disclosure. Below is the related question from the Attorney General form:

The Department of State has not published similar instructions, but there is good news for applicants. While the Department of State is only beginning to establish procedures for filing these reports, they intend to redact all private information from Schedule B.

Updates to Financial Statement Requirements

The New York Attorney General’s Office requires registering organizations to submit financial statements along with Form CHAR500 and other attachments. The type of financial statements needed depends on the organization’s total annual revenue and support. Beginning July 1, 2021, these thresholds will be changing.

Total revenue and support can be found on Form 990, Part I, Line 12 or Form 990-EZ, Part I, Line 9 of the organization’s most recently completed tax year. Note, this total represents all sources of revenue, not just revenue earned in NYS.

Below are the thresholds, again starting July 1, 2021:

- Between $250,000 and $1,000,000, reviewed financial statements (increased from $750,000)

- Over $1,000,000, audited financial statements (increased from $750,000)

Note: New York is one of many states that require organizations to produce reviewed or audited financial statements when registering to solicit. Organizations are encouraged to review this state-by-state requirements guide and speak with an accounting professional about their specific requirements prior to submitting registration materials.

What Has Changed Under Executive Law 172-E and 172-F?

Funding Disclosure Report for 501(c)(3) Organizations Making In-Kind Donations to 501(c)(4)s

Section 172-E of the law creates a funding disclosure report requirement for 501(c)(3) organizations that make in-kind donations exceeding $10,000 to certain 501(c)(4) organizations. Whether or not the 501(c)(3) must file depends on the NYS-specific lobbying activities of the 501(c)(4). For more information, review this publication by the Lawyers Alliance for New York.

Financial Disclosure Report for 501(c)(4) Organizations

Section 172-F of the law creates a financial disclosure report requirement for 501(c)(4) organizations that engage in lobbying activities in NYS. For more information, review this publication by the Lawyers Alliance for New York.

Both the Funding Disclosure or Financial Disclosure reports are filed with the New York Department of State. It’s important to note that by filing either one of these reports, organizations are generally also required to file the annual financial report as covered by Executive Law 172-B:

“Any registered charitable organization that is required to file an Annual Financial Report pursuant to subdivision one or two of the Executive Law Section 172-b, or that is required to file a Funding Disclosure Report pursuant to Executive Law Section 172-e, and/or a Financial Disclosure Report pursuant to Executive Law section 172-f for a reporting period during the applicable fiscal year shall also be required to file such Annual Financial Report, including all required forms and attachments, with the Department of State.”

Consolidated Laws of New York, Executive Law, § 172-B (2021). https://www.nysenate.gov/legislation/laws/EXC/172-B

To date, at this time the Department has not developed paper forms for the Funding Disclosure and Financial Disclosure reports and is currently developing detailed instructions. We will update this article with links and more details upon their release.

The Impact of These Changes

The recent change resulting from Executive Law 172-B introduces an additional filing requirement for many nonprofits that register to solicit contributions in NYS. Understandably, there has been some public pushback against the changes, particularly pertaining to Schedule B reporting requirements. Notably, similar challenges have been taken up as high as the U.S. Supreme Court.

For the foreseeable future, organizations impacted by these changes should take prompt action to ensure they meet the additional requirements. Nonprofits that manage state registrations and reporting in-house need to establish processes to ensure that the additional filings are made on time.

State requirements, particularly administrative rules, change frequently. Harbor Compliance maintains constant communication with state agencies across the United States. With our proprietary database of requirements and a team of registration experts, we help client organizations stay ahead of any legislative and administrative changes.

Harbor Compliance is a nationwide provider of fundraising compliance services. With our nationwide network of registered agent offices and charitable registration expertise, we can help you prepare and file the additional renewal required by the Department of State. We manage every aspect of registration so you can concentrate on your organization’s mission and programs.

© 2021 Harbor Compliance. All rights reserved.

Harbor Compliance does not provide tax, financial, or legal advice. Use of our services does not create an attorney-client relationship. Harbor Compliance is not acting as your attorney and does not review information you provide to us for legal accuracy or sufficiency.