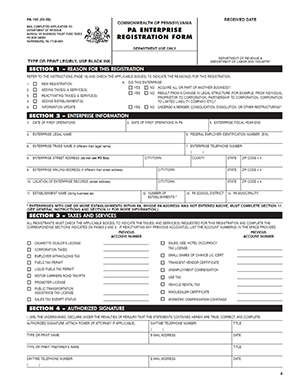

PA-100: Pennsylvania Business Tax Registration

We prepare and file your PA-100 Form to register your business for state taxes.

- Fulfill your obligation to register your business for state tax accounts

- Save time as we take care of your 14-page application

- Unlike accountants who bill by the hour, our service costs one up-front flat fee.

- Work one-on-one with a filing specialist through the entire process

How it Works

What is Form PA-100?

Form PA-100 (Pennsylvania Enterprise Registration Form) is used by Pennsylvania businesses to register for certain tax accounts with the Pennsylvania Department of Revenue and the Pennsylvania Department of Labor and Industry.

- New businesses file PA-100 to set up state tax accounts.

- Existing businesses file PA-100 to add or amend state tax accounts.

Pennsylvania issues multiple tax IDs - one for each tax account number (box number). For example, if your business sells candy bars and has employees, you will have separate tax accounts with the Pennsylvania Department of Revenue for sales tax and employer withholding tax.

Filing PA-100 obtains the following PA Tax Accounts:

Sales tax account(s):

- Sales Tax

- Local Sales Tax (Philadelphia and Allegheny Counties)

- Hotel Occupancy Tax

Employer tax account(s):

- Employer Withholding Tax

- Unemployment Compensation

- Workers' Compensation Coverage

Wholesaler tax account(s):

- Wholesaler Certificate (also known as a Reseller’s Certificate)

Use tax account(s):

- Use Tax

Specific products, services, or activities:

- Malt Beverage and Liquor Tax

- Cigarette License / Tax

- Small Games of Chance

- Liquid Fuels and Fuels Tax

- Motor Carriers Road Tax

- Financial Institution Taxes

- Promoter License

- Transient Vendor Certificate

- Gross Premium Tax (applicable to insurance companies)

- Public Transportation Assistance Tax

For a fuller introduction to the PA-100 tax accounts, read PA-100 General Requirements.