-

Software

Compliance Software

Oversee licenses, track renewals, access documents, and more from a single interface.

Software Overview -

Services

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

Services Overview -

Industries

-

Partner

- Information Center

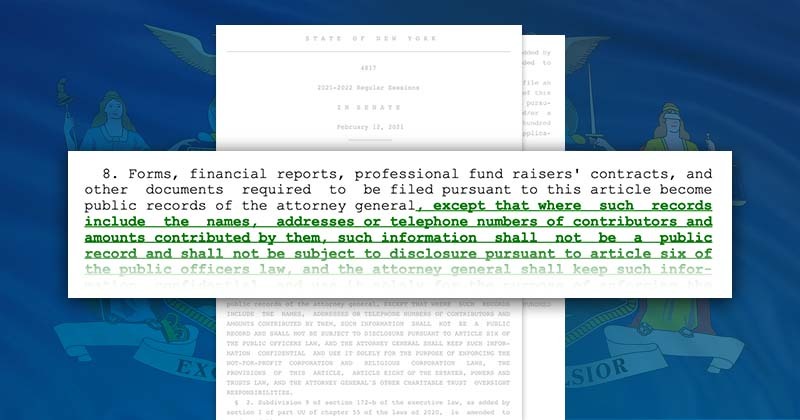

New York Repeals Duplicate Filing Requirement for Registered Nonprofits

On November 12, 2021, New York Governor Hochul signed S4817a/A1141a, which repeals the redundant filing requirement for New York nonprofit organizations introduced earlier this year.

Under the former law, nonprofits would have been required to file the same annual registration forms, IRS Form 990, and financial statements with both the New York State Office of the Attorney General and the New York State Department of State. The former law was immediately met with opposition from nonprofits, practitioners, and their allies throughout the sector.

Following Gov. Hochul’s signing of S4817a/A1141a, nonprofits are once again required to register and report annually only with the Attorney General’s Office, which has enforcement authority over nonprofits operating in New York State. This news is generally received as positive for the sector, as it removes an unnecessary administrative requirement from nonprofits that solicit in New York.

For more information on the current registration requirements in New York or in any state, visit our nationwide Fundraising Compliance Guide.

State requirements, particularly administrative rules, change frequently. Harbor Compliance maintains constant communication with state agencies across the United States. With our proprietary database of requirements and a team of registration experts, we help client organizations stay ahead of any legislative and administrative changes.

Harbor Compliance is a nationwide provider of fundraising compliance services. We manage every aspect of registration so you can concentrate on your organization’s mission and programs. Click the button below if you would like to learn more.