-

Software

Compliance Software

Oversee licenses, track renewals, access documents, and more from a single interface.

Software Overview -

Services

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

Services Overview -

Industries

-

Partner

- Information Center

May 15 Filing Deadline: Charitable Solicitation Registration

Mark your calendars! If your nonprofit’s fiscal year ends on December 31, state charitable renewals are due starting May 15. Note that this coincides with the IRS Form 990 due date.

Most states require a copy of Form 990 to be included with the registration renewal application. Because of this tight filing window, nonprofits often struggle to obtain financial reports from their tax preparers and file with each state on time. But submitting renewals doesn’t have to be a sprint to the finish line. Here are three proactive measures you can take to ensure your organization remains in compliance with state deadlines:

1. Determine Where You Must File

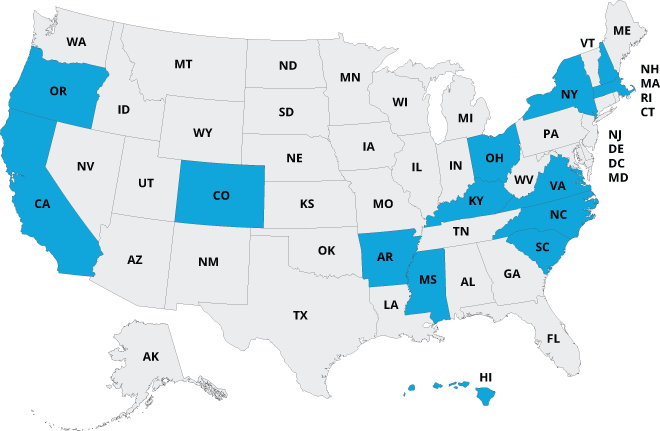

For charitable organizations with a fiscal year ending December 31, your renewal will be due by May 15 in the following states:

- Arkansas

- California

- Colorado

- Hawaii

- Kentucky

- Massachusetts

- Mississippi

- New Hampshire

- New York

- North Carolina

- Ohio

- Oregon

- South Carolina

- Virginia

For organizations with a fiscal year not ending on December 31, your due date is easy to calculate. Simply add four months and 15 days after the close of your fiscal year. For example, if your fiscal year ends June 30, your renewals are due November 15.

2. File for State Extensions

Nonprofits whose 990 and financial statements will not be complete prior to the May 15 deadline must file extensions with each state. In most cases, this is a separate and additional task from filing extensions with the IRS (Form 8868). You may, however, have to include a copy of Form 8868 when filing with the states.

Submitting extensions to state charity officials gives your organization up to six extra months to file its renewal without incurring penalties for late filing. The process for submitting extensions varies in each state, and each state grants a different amount of time to file.

Please note, nonprofits that are not eligible to file a federal extension generally must file their state renewals on time.

3. Fully Manage Your Organization’s Compliance

Organizations of all sizes spend countless hours of staff time managing renewal deadlines and extensions without software or intimate knowledge of state procedures. On top of that, not all state renewal dates line up with an organization’s tax year, and state penalties can be severe. Harbor Compliance takes a proactive approach to registration and staying compliant. Our clients can count on full-service management of the entire process and gain access to our proprietary software.

Contact us to learn about what our compliance solutions can do for your organization.