-

Software

Compliance Software

Oversee licenses, track renewals, access documents, and more from a single interface.

Software Overview -

Services

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

Services Overview -

Industries

-

Partner

- Information Center

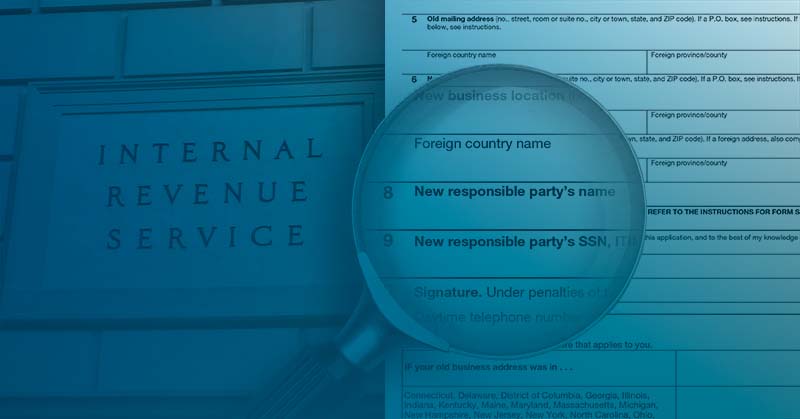

IRS Now Requires Entities to File Updates to Responsible Party

Effective July 30, 2021, the Internal Revenue Service (IRS) urges entities with Employer Identification Numbers (EINs) to update the federal records if there has been a change in the responsible party or contact information. Citing security measures, the IRS reminds entities of the requirement for EIN holders to update responsible party information within 60 days of any change.

What is a Responsible Party?

Per the IRS, the responsible party is the “true principal officer, general partner, grantor, owner or trustor” of the entity. The responsible party “controls, manages, or directs the applicant entity and the disposition of its funds and assets.”

In other words, the responsible party is generally in charge of the entity. They are designated on Form SS-4 at the time of EIN issuance, providing an SSN or ITIN during the process. In the event the IRS needs to correspond with the entity, the responsible party is who they will contact first.

Who Does This Change Apply To?

Most businesses entities, not just employers, are required to obtain an EIN. While the requirement to update responsible party information is not new, the IRS’s recent insistence on compliance is.

We will not speculate as to whether this foreshadows additional enforcement. However, Harbor Compliance encourages entities to take proactive steps to ensure they designate and maintain a reliable responsible party with the IRS.

How Do I Change My Business’s Responsible Party with the IRS?

Entities can report any change in responsible party by filing Form 8822-B, Change of Address or Responsible Party – Business. The same form is used if the business’s location or mailing address changes. Form 8822-B can be mailed to the IRS using the address at the bottom of the form.

Note, due to COVID-19, IRS processing time is substantially longer than usual. Entities filing Form 8822-B should save copies of filed forms in their records and expect a delayed response.

Harbor Compliance tracks legislative changes and maintains regular contact with state agencies. We help client organizations achieve registration and navigate a changing landscape of complex requirements.

Want to see how our compliance solutions can benefit your organization? Start the conversation by clicking the following link:

© 2021 Harbor Compliance. All rights reserved.

Harbor Compliance does not provide tax, financial, or legal advice. Use of our services does not create an attorney-client relationship. Harbor Compliance is not acting as your attorney and does not review information you provide to us for legal accuracy or sufficiency.