-

Software

Compliance Software

Oversee licenses, track renewals, access documents, and more from a single interface.

Software Overview -

Services

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

Services Overview -

Industries

-

Partner

- Information Center

Countdown to the Corporate Transparency Act: How to Prepare for Beneficial Ownership Information Reporting

The clock is ticking, and the deadline for beneficial ownership information (BOI) reporting is fast approaching. The Corporate Transparency Act (CTA) has brought about significant changes in the regulatory landscape and may have real impacts on teams across your organization. This blog post will dive into what the CTA means for your teams and how it impacts your organization’s reporting obligations.

The New Requirements in Brief

The primary objective of the CTA is to enhance corporate transparency by mandating companies to disclose information about their owners. A beneficial owner is any individual who exercises substantial control over an organization or owns or controls at least 25% of its ownership interests.

Organizations required to report BOI under the CTA, referred to as “reporting companies,” must report information about the organization and beneficial owners to the Financial Crimes Enforcement Network (FinCEN).

Failure to meet requirements imposed by the CTA can have ramifications for your organization. Penalties may include substantial fines of up to $500 per day and, in cases of deliberate violation, even criminal charges. Therefore, your team must proactively fulfill reporting obligations.

Preparing for the Requirements in Three Steps

It’s estimated that 97% of organizations operating in the US will need to report beneficial ownership information to FinCEN. Organizations formed before January 1, 2024 that aren’t exempt from the requirements can prepare for the upcoming deadline by following the steps below.

1) Identify Your Beneficial Owners

Beneficial owners are individuals who exercise substantial control over an organization or own or control at least 25% of its ownership interests. Either qualification is valid, meaning identifying beneficial owners is a two-part process.

Part 1: Individuals with substantial control

Generally, individuals with substantial control may be:

- Senior Officers – CEOs, Presidents, CFOs, General Counsel, COOs, or any other officer who performs similar functions as these officers, regardless of title.

- Individuals with Appointment or Removal Authority – Anyone able to appoint or remove any senior officer or a majority of the governing body, such as the board of directors.

- Important Decision-Maker – Anyone with the power to make or influence important decisions, such as:

- Determining the nature, scope, and attributes of the business, choosing or ending lines of business, engaging in new ventures, shifting geographic focus, or entering into, ending, or determining whether or not to fulfill major contracts.

- Selling, leasing, mortgaging, or transferring principal assets, making major expenditures or investments, issuing equity, incurring significant debt, approving operating budgets, or designing compensation plans for senior officers.

- Reorganizing, dissolving, or merging the organization with another, or amending any substantial governing documents of the organization, including formation documents, bylaws, and significant policies or procedures.

Individuals with any other form of substantial control over the organization. Control exercised in new and unique ways can still be substantial. For example, flexible corporate structures may have different indicators of control than the indicators included above.

Part 2: Individuals with at least 25% ownership interests

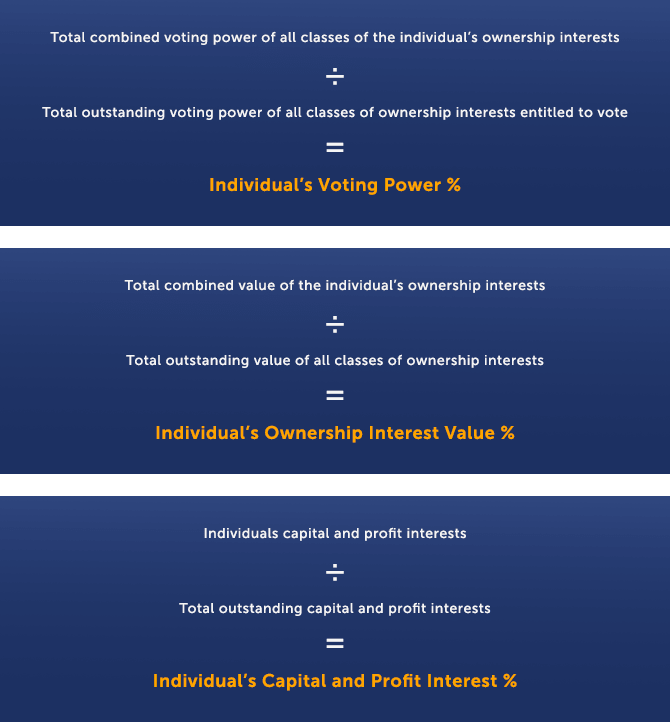

In general, ownership interests may include equity, stock, or voting rights; a capital or profit interest; convertible instruments; options or other non-binding privileges to buy or sell any of the foregoing; and any other instrument, contract, or other mechanism used to establish ownership. Also, a reporting company may have multiple types of ownership interests.

The formulas below are useful in determining ownership interest percentages:

If none of these calculations apply, identify any individual who owns or controls 25% or more of any class or type of ownership interest at the organization.

2) Gather the Information Required to File

BOI reports require specific information about your organization and its beneficial owners. As such, gathering the information is a two-part process.

Part 1: Company information

- Name(s) – For every organization you plan to report on, you will need its legal entity’s full name along with any trade name or “doing business as” (DBA) name.

- Address – List the organization’s complete current US address. If the organization’s principal place of business is outside the US, use the primary location in the US where the organization conducts business.

- Formation Jurisdiction – List the state, tribal, or foreign jurisdiction where the legal entity was formed. If you’re reporting an entity formed in a foreign jurisdiction, you’ll also need to report the state or tribal jurisdiction where the organization was first registered to do business in the US.

- Tax ID Number – List the organization’s Internal Revenue Service (IRS) Taxpayer Identification Number (TIN). An Employer Identification Number (EIN) is an example of a TIN. If you’re preparing a report for an organization formed in a foreign jurisdiction for which no TIN has been issued, report a tax identification number issued by a foreign jurisdiction and the name of the jurisdiction.

Part 2: Beneficial owner information

For every beneficial owner, you’ll need to provide the individual’s full legal name and date of birth. A complete current residential street address is also required. Note that the address doesn’t have to be in the US.

Each beneficial owner must also provide an image of one of the following non-expired forms of identification:

- US passport

- State driver’s license

- ID document issued by a state, local government, or tribe

- A foreign passport is acceptable only if the individual has none of the above-identifying documents.

3) Securely Store Your Information and Take Steps to Maintain It

Once you’ve gathered all the information required to complete the BOI report, storing and keeping the information up to date until it’s time to file is vital. Consider the following as you design your storage and maintenance processes.

BOI is personal identifiable information (PII)

Establishing stringent protocols and procedures to prevent unauthorized access, data breaches, or misuse is necessary. Adopting technologies for data encryption, secure storage, and regular audits can further fortify these controls, but these steps can be costly.

Training and educating your staff to understand their roles and responsibilities concerning BOI can also bolster the security of data-handling processes. However, no training program is perfect, and mistakes may occur.

Records Manager, part of the Harbor Compliance Software Suite, is purpose-built to store corporate records, track ownership and leadership, maintain board meetings and minutes, and more.

Changes in BOI must be reported to FinCEN within 30 days

BOI reporting is more than just a one-time filing. As information about beneficial owners changes, organizations must complete updated report filings to notify FinCEN of the updates. This means organizations have obligations beyond simply storing static information to complete BOI reports; they must maintain the information as it changes over time. Unlike the solutions offered by other providers, up to four initial, updated, and corrected reports are included in Harbor Compliance’s BOI Reporting Service annually.

Conclusion

As the countdown to BOI reporting continues, your team must prepare to meet the Corporate Transparency Act’s requirements. By identifying your beneficial owners, gathering the information required to file, and implementing robust internal data controls, you can confidently navigate this new regulatory requirement.

Harbor Compliance’s full-service support is the easiest way to stay ahead of the new requirements. Sign up today and experience:

- Simple, secure online information collection

- Centralized data storage that streamlines information tracking and updates

- Automated notifications to keep you up to date on ongoing filing requirements

- Filing support for initial, update, and correction reports

The result is that you spend more time focused on your strategic priorities and less time worrying about government filing requirements.