-

Software

Compliance Software

Oversee licenses, track renewals, access documents, and more from a single interface.

Software Overview -

Services

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

Services Overview -

Industries

-

Partner

- Information Center

End of Year Compliance for Nonprofits 2015

Posted on November 16, 2015 by Harbor Compliance in Nonprofit Compliance.

The end of the year is the most important time for nonprofit organizations. Not only does over 30% of annual giving occur in December, but the end of year also coincides with a number of compliance requirements. These state, IRS, and record keeping requirements are the focus of today’s post. Staying on top of state and IRS filings, and staying organized internally will close out 2015 cleanly, and lead to smooth sailing in 2016.

In a nutshell, “compliance” is the series of activities your nonprofit must do in order to stay in good standing with the state and the IRS. Missing a filing, keeping bad records, and failing to abide by state and IRS requirements can jeopardize your organization and its federal tax exemption.

Of course, we don’t want that to happen! What follows is a short list of state, federal, and record keeping activities that are common to most organizations. Not all of these activities may happen at the end of the year, and your organization’s specific requirements may vary. The purpose is to get your organization thinking about the importance of compliance.

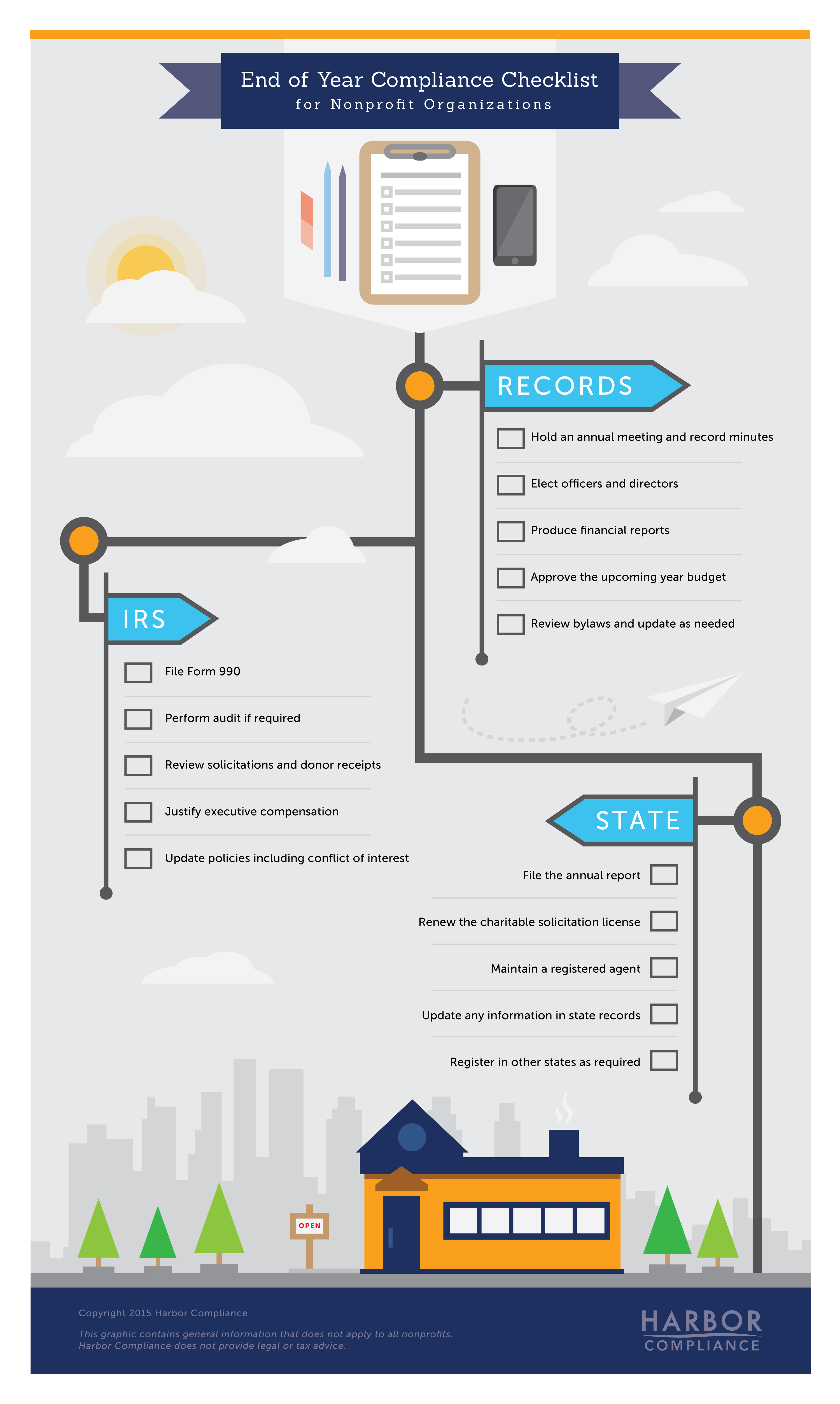

If you’re a visual learner, you can also review this infographic:

Planning and Record Keeping

- Hold an annual meeting – If you have not held an annual meeting, do so before the end of the year. Be sure to keep minutes!

- Produce financial reports – At that meeting, review the numbers from the past year. How did the organization do? What percentage of revenue went towards its charitable purpose and programs?

- Approve next year’s budget – Discuss and approve a budget for next year’s activities.

- Elect officers and directors – If your officers and directors have term limits, or there is a vacancy that needs to be filled, the annual meeting is a great time to elect or re-elect these leaders.

- Review bylaws and update as needed – Be sure to review your bylaws. Are there any changes needed to that document, in order to keep it current with how your nonprofit “does business?”

State Compliance

- File your Secretary of State annual report – If your state’s corporation requires, you must file a report to keep your nonprofit corporation (the legal entity) in good standing.

- Maintain a registered agent – Every state requires your nonprofit corporation to have a registered agent in each state where it is registered to transact business. If your registered agent is an individual, are they aware of their responsibilities? Are they still associated with your nonprofit, and at the same address? Consider hiring a reliable service company, which means you’ll meet the state’s requirements just by paying your annual invoice.

- Obtain or renewal charitable solicitation licenses –Most states require your charity to register prior to fundraising. This license must be renewed annual in almost every state, otherwise your charity can face fines and penalties. If this is a new concept to you, review our Fundraising Compliance Guide.

- Update changes in information with the state – this sometimes goes hand-in-hand with your annual report, and other times it’s a separate filing. If your organization’s name, address, or leadership changes, be sure to file with each state’s corporations division to formalize the change.

- Register in other states – If your organization has started to transact business in another state, be sure to register with that state’s corporations division. Common reasons include purchasing property, hiring an employee, and fundraising, though this list is far from exhaustive!

IRS Compliance

- File your 990 return – For nonprofits on a calendar fiscal year, your IRS 990 return due date is May 15, 2016, but preparation should begin now, as it requires extensive information on your leadership, finances, and operations.

- Perform an independent audit, if required – Organizations of a certain size are required to have their finances audited or reviewed.

- Review solicitations and donor receipts – Do they meet IRS guidelines? Do they include the appropriate state disclosures?

- Justify executive compensation – The IRS has tests for whether your executives are compensated reasonably, which depends on a number of factors. If you don’t feel comfortable doing this review yourself, seek outside help!

- Update policies, including conflict of interest – The IRS requires that your organization circulate a conflict of interest policy. This document must be annually certified. You may have other policies, such as a whistleblower policy, that need updating.

Compliance is an ongoing responsibility; not just an “end-of-year” clean-up activity. The end of the year is ideal for assessing your organization’s standing across multiple states and government agencies. With good compliance management, you’ll be able to take on new challenges and new donors in 2016!

Harbor Compliance specializes in 501(c) formation and compliance. We monitor government changes, due dates, and help you stay on top of complex (and unfamiliar) responsibilities. You can learn more and request information about our turnkey compliance solutions through our website.