-

Software

Compliance Software

Oversee licenses, track renewals, access documents, and more from a single interface.

Software Overview -

Services

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

Services Overview -

Industries

-

Partner

- Information Center

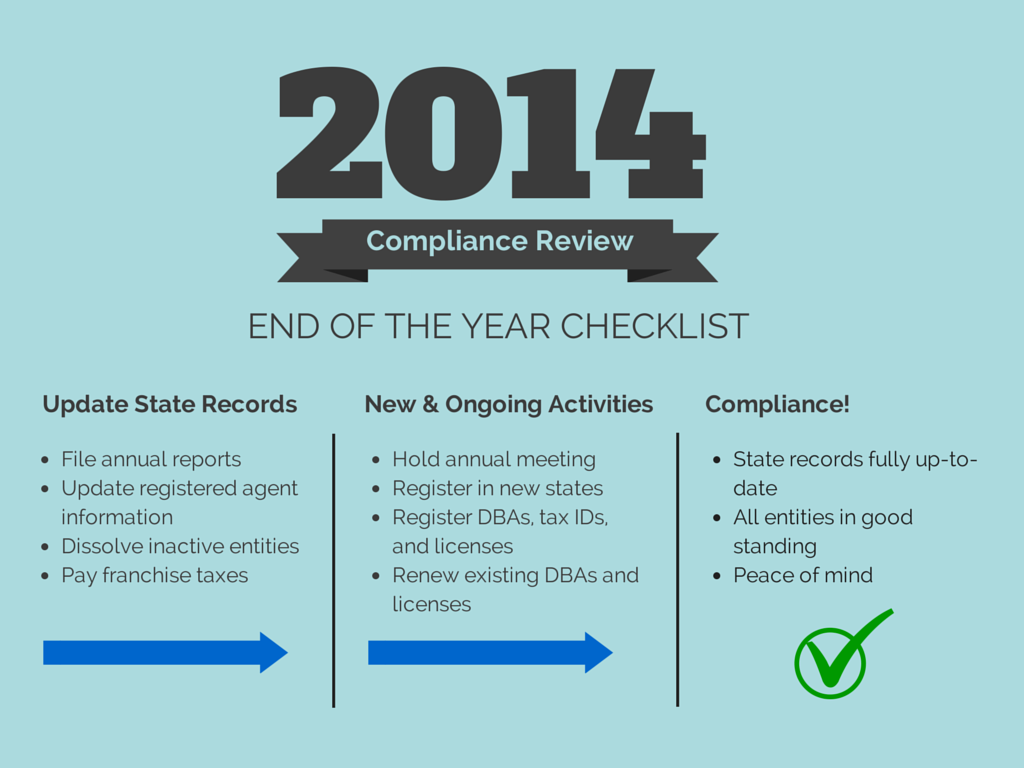

End of the Year Compliance for Small Businesses

Posted on November 10, 2014 by James Gilmer in Business Compliance.

The end of the year is the ideal time to review compliance for your business. For many businesses, this is a time to “catch up” on compliance activities for the year and prepare for next year. Filings also may be due in the fourth quarter.

End of the year compliance involves a comprehensive review of all your entities and activities of the past twelve months, and preparation for upcoming filings, including new registrations, annual reports, and renewals.

What follows are ten end of the year compliance activities your business should account for. Your business might have more requirements than what I’ve listed; alternatively, they might not all apply to you. Rather, use this list to get thinking about the importance of business compliance.

1. Do you need to file an annual report?

Many states require you to file an annual or periodic report with the Department of State. States have different names for this filing, for instance, “statement of information” in California. Annual filings list the current information for your business including principal address, registered agent, and officers/directors. Failure to file the report by the deadline can result in penalties, fines, loss of good standing, or administrative dissolution.

In addition to an annual report, some states, such as California and Delaware, have an annual franchise tax. The amount depends on the type of entity you maintain and its size. Make sure you have paid this tax to avoid costly penalties.

2. Have you changed registered agents, and renewed your registered agent service?

Did your current registered agent’s information change? Did you break up with an abusive registered agent service provider? If you did, be sure to inform the state of such changes.

If you use a commercial registered agent, be sure to renew your service in each state for each entity. Failure to pay your invoice on time may lead to unnecessary fees or discontinuation of service.

3. Do you need to file a DBA or fictitious name?

If you started doing business, or operating a brand under a different name, you might have to register a DBA or fictitious name with your state- or county-level authority.

4. Have you renewed all DBAs and fictitious names?

Some states and counties have a periodic DBA renewal requirement. If you have active DBAs for your business, make sure they are all up-to-date in all locations.

5. Do you need to register in new states?

If you have plans to transact business in another state, make sure you register in that jurisdiction. This process, called “foreign qualification,” includes appointing a registered agent, obtaining a Certificate of Authority, registering for applicable taxes, and obtaining necessary licenses and permits. Failure to register, or starting business before your application is approved can lead to setbacks and costly penalties.

6. Have you hired a new employee?

If you’ve hired a new employee, make sure your IRS filings and employment insurance are up-to-date. If you’ve hired an employee in another state, you’ll have to register to transact business there (see #5).

7. Have you started selling a new product?

If you plan to, or have started to sell a new product, you might have to register for specific sales taxes, and applicable licenses and permits. For example, many states regulate the sale of motor vehicles, firearms, alcohol, tobacco, and chemicals. This is far from an exhaustive list of regulated products, so check with the state, or use our License Research solution to determine your business’ needs.

8. Have you registered for applicable taxes?

Have you registered for applicable corporate taxes (sales, employment, use, etc.) in each location where you conduct business? This includes state and local level taxes.

Over the past year, if your business revenue has changed significantly, you might file for S-Corp or C-Corp status with the IRS. This must be filed within 75 days of the beginning of the year, so make sure this is one of your end of the year compliance activities.

9. Are your business licenses and permits up-to-date?

Make sure your business is up-to-date on its licenses and permits in all locations. This includes obtaining licenses before you begin transacting business, and complying with any renewal requirements for a specific license.

10. Have you closed a location or your whole business?

If you closed a location, stopped transacting business in a state, or shut your doors entirely, make sure you have paid all due taxes in that jurisdiction. After that, file all the appropriate withdrawal and dissolution paperwork to complete the process. If you don’t, your entity will continue to exist, and so will those taxes!

Conclusion:

Again, I will stress: your activities and requirements will differ from my list. Understand however that negligence or blatant failure to comply with various state, federal, and local requirements can lead to fines, loss of good standing, and other penalties.

Now that I’ve sufficiently scared you, you have two options. First, perform an end of the year compliance review yourself. If you have a small business in one location with no employees, it’s not too difficult. If you’re managing a company in several locations with many employees, it can be a complicated task, even for a team of people.

Your second option is to let Harbor Compliance do your end of the year compliance review for you! With our Annual Compliance Solution, you will meet with your compliance specialists, who will review your business’ activities over the past year and inform you of any missing or upcoming filings. We can also prepare and file most necessary registrations in any jurisdiction. Start 2015 with peace of mind – simply contact us to get started!