Not-For-Profit vs. For-Profit

This article is designed for social entrepreneurs struggling with the very fundamental question of whether their organization is not-for-profit, for-profit, or something else.

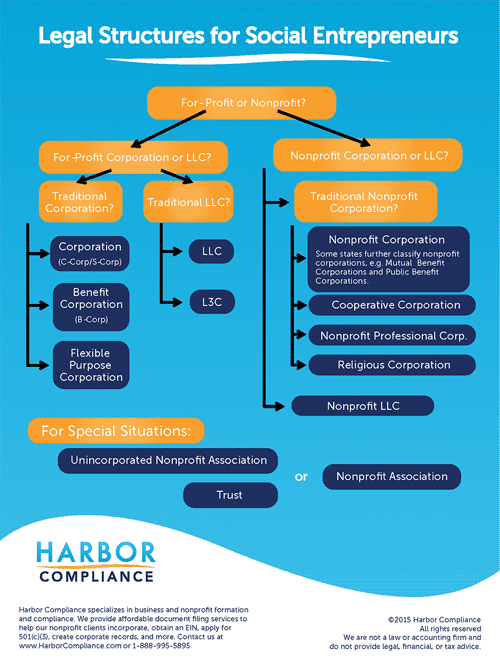

New Blended Legal Structures

Better World Books collects and sells books online in order to donate books and fund literacy initiatives worldwide. You might think they are a for-profit because they are running a business in which they sell products. You might think they are a nonprofit because their ultimate goal is to donate books and fund literacy.

Modern social entrepreneurs like Better World Books are blurring the lines between traditional for-profit and nonprofit organizations. In response, law makers have introduced new legal structures like B-Corporations, L3Cs, and Flexible Benefit Corporations. (Better World Books is a B-Corp.)

Navigating these new structures is never easy, which is why Harbor is happy to share the below diagram.

How to Decide

As you can see, the first step is to determine whether the organization is, ultimately and truly in its heart, a for-profit or a not-for-profit.

If the organization will not obtain 501(c) federal income tax exemption, don’t start a nonprofit. A nonprofit that does not obtain exemption simply doesn’t make sense because there are no owners to whom you can distribute profits..

To take it one step further, if your organization can obtain 501(c) tax exemption it probably should. The benefit of 501(c) is obvious – all the money saved on taxes can go back to furthering your cause. If your organization qualifies for exemption, use it to the advantage of your mission.

Use the following five tests to help you decide.

- Primary purpose “smell test”

Does the primary purpose of your organization align with a traditional 501(c) exemption – such as a charitable, religious, or educational purpose? See chart of nonprofit tax exemptions. - Unrelated Business Income (UBI)

Technically, 501(c)s are limited to conducting the exempt purpose stated in their formation documents. In practice, 501(c)s sometimes collect unrelated business income and pay taxes on this portion. If you start collecting too much UBI, you are at risk of losing your 501(c) status and owing back-taxes. The IRS decides this by conducting an “operational test” to consider if the nonprofit is being run in line with it’s exempt mission. - Will you seek private funding and reward investors?

Nonprofit 501(c)s primarily obtain funding from donations, grants, membership dues, and other tax-exempt income sources. For-profits attract shareholder-like investors and can obtain SBA-backed loans. Nonprofits never disburse profits to owners and investors; they are prohibited from private inurement. - How much control do you want of the organization?

Control in for-profit corporations is clearly in the hands of shareholders who vote their shares. A founder can keep control by holding 51% or more of outstanding shares. The founder of a non-profit should expect community-based decision-making by the board of directors. - Personal pay-out

As a social entrepreneur, how will you personally be compensated? A non-profit permits a “reasonable” salary. Along the same lines, what is your exit strategy? You cannot one day “sell” a nonprofit for a pay-out.

Still undecided? Some organizations create for-profit and non-profit entities in tandem. These can be structured in a parent-child or brother-sister arrangement.