-

Software

Compliance Software

Oversee licenses, track renewals, access documents, and more from a single interface.

Software Overview -

Services

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

Services Overview -

Industries

-

Partner

- Information Center

Best Practices in Managing Charitable Solicitation Compliance

In our last post, we discussed why fundraising compliance should be a priority for every charity. Compliant organizations avoid state-imposed penalties, are able to fundraise limitlessly, and benefit from a higher rate of return on their solicitations. In this post, you’ll get a sneak peak of the best practices we’ve refined through our deep industry expertise of providing turn-key solutions to clients of every size, in every state, and from 28 countries overseas.

If you are new to the topic of charitable solicitation, remember, registration is generally required in any state in which your charitable organization solicits funds. Soliciting is the simple act of asking for donations, even through email or your website. Each state has their own set of charitable solicitation laws, resulting in a time-consuming maze of licensing requirements, application forms, renewal due dates, fundraising disclosures, and more. Once initial registration is completed, charities must renew their licenses, thus creating an ongoing process of management.

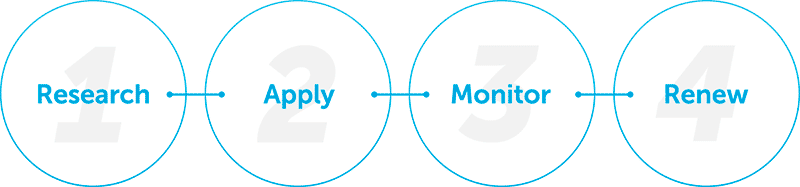

The steps to properly manage charitable solicitation registration include research, apply, monitor, and renew.

Each step has its own complexities and corresponding best practices. We recommend following these steps in order.

1.) Research

Registering for charitable solicitation should start with careful research and an audit of the current license status in each state. Once we have completed the necessary research, we compile and send a Status Research Report containing the current statuses, application fees, and prerequisites required to complete the registrations.

License statuses

Researching the status of charitable solicitation licenses in each state will reveal whether a charity is in good standing, delinquent, or not registered. There are usually a couple surprises that are uncovered, for instance, registrations that were completed by previous staff but were not maintained. Identifying these situations is critical to moving forward with registration. As part of researching the status in each state, we identify the license numbers, initial registration dates, renewal dates, and other critical information.

Application forms and fees

To save time, we simultaneously identify the details we will need for Step 2 (Apply), including the correct application forms, fees, required supplementary information, and any additional requirements. These details vary by state and for each organization. Having complete research up front provides a clear path forward and avoids wasted time and expense when it comes time to file the applications.

Additional requirements

Seven states require charities to complete a separate registration with the secretary of state office prior to registering for charitable solicitation. This process is called foreign qualification. Sixteen states require appointment of a registered agent to receive legal documents and government notices on behalf of the organization. We identify the requirements that apply to each client’s situation and provide the necessary foreign qualification and registered agent services.

2.) Apply

The second step is to carefully complete and file each application. Depending on the registration status, the application will be to either obtain a new license, request exemption from licensure, restore a lapsed license to good standing, or complete a renewal.

Here are some of the best practices our specialists have developed when preparing applications:

- Most states have more than one application form. Use the appropriate form for the organization’s specific situation.

- Some states offer exemptions from registration that reduce a charity’s fees. Identify if the charity qualifies for an exemption and apply for and renew those exemptions to ensure compliance.

- Remit payment using the best available option for that state which may be by check, certified check, or online payment.

- Use the application forms provided by each state, which are generally processed faster than the now-outdated Unified Registration Statement (URS).

- File using the fastest available method in each state to expedite approvals. Depending on the state, the best option may be by mail, fax, email, or online.

- Some states require multiple submissions in a given year, and extensions may be necessary if the 990 is not ready in time. Keep track of each filing and avoid missing a due date.

Our team has developed these insights through extensive experience and is able to provide the most streamlined and cost-effective process for our clients. Our filing specialists fully manage all aspects of the process including preparing the state forms, compiling the applications, cutting the checks, and submitting the applications. We invoice the total fees required in each state and disburse those payments on our client’s behalf, thereby reducing the number of accounts payable from 41 to just one, which significantly reduces billing overhead. We track the approval of each application and provide real-time reports through our proprietary software.

3.) Monitor

Monitor the applications through the state review process, and follow-up proactively until they’ve been approved, which can take up to eight months. Follow-up with state application examiners if the expected processing time is exceeded, as state offices may misplace applications or send approvals to the wrong address.

Generally, state correspondence in response to applications take three forms: rejections, requests for more information, and approvals.

Rejections are the worst case scenario and can result from a variety of mistakes including submitting inaccurate information or incomplete applications. Requests for more information can also result from submitting conflicting information or failing to include all required documents. Since charities are generally required to obtain solicitation licenses prior to fundraising, application delays can cost an organization in missed donations.

Approvals are the best outcome. Our expertise in completing registrations in every state helps ensure applications are approved outright. Once approved, it is imperative that you keep the state correspondence and registration information for your records, including license numbers, effective dates, renewal dates, etc. This information will be necessary for renewals. Our proprietary software stores this data for real-time access and reporting.

4.) Renew

After all licenses are approved and in good standing, implement processes to manage renewals, maintain records of licenses and information, monitor regulatory and state administrative changes, and be able to readily provide status reports upon request.

Staying compliant requires filing renewals for each registration and is necessary to avoid penalties and adverse consequences. States have different registration and exemption renewal periods. Renewals may be required annually, biennially, or even at multiple points in one year. Depending whether your IRS 990 and audited financial statements are available by the renewal dates, you may also need to file extensions on a regular basis. Renewal deadlines are frequently calculated based on your fiscal year end date or initial registration date. To make matters worse, state requirements are constantly changing.

It’s not uncommon for charities to create a combination of spreadsheets, calendars, and file folders in an attempt to manage the renewal process in-house. Charities ultimately find these disjointed systems are inefficient and incomplete, and invariably lead to missed renewals, lapsed licenses, and confusion between staff members.

Our charitable solicitation compliance solutions eliminate these inefficiencies through full-service management and proprietary software.

Best practices for renewing charitable solicitation licenses include:

- Track the various due dates and meet each deadline. File extensions with the states if the 990 is not ready to allow for timely renewal.

- Accurately determine the application fees each year, which may fluctuate year-to-year as state fees and the organization’s revenue change.

- Use a streamlined process for compiling state fees to create reports for finance teams to assist with budgeting.

- Store copies of all licenses and state correspondence, and maintain a record of registration numbers and approval dates. Provide access to multiple staff members and ensure the information is backed-up in case information is lost, misplaced, or destroyed.

- Assign the tasks of managing compliance in such a way that ensures continuity as staff members change roles.

- Quickly generate reports for boards and leadership teams on registration statuses, costs, and further details as needed.

- Include disclosure statements on solicitations, which are an integral component of compliance in the 24 states that have such requirements.

- Monitor regulatory changes that affect which states require charitable solicitation registration and related requirements. Also stay current with administrative changes within the charity authorities that can also affect application forms, fees, available filling options, and more.

While initial registration is necessary, managing renewals to avoid any lapsed registration is equally, if not more important. Our software provides real-time access to the license numbers, statuses, due dates, and state fees. Paired with our full-service management, our clients rest assured that the complexities of compliance will be handled on their behalf to virtually eliminate their time investment.

Moving Forward

It’s no secret that managing charitable solicitation compliance is a complex and time-consuming task. Our approach is to pair software with expertise to allow organizations to fully outsource the responsibilities. Regardless of what stage an organization is in, we follow the best practices outlined in this article to help ensure organizations are compliant while minimizing their time and financial investment. Learn about how you can put your compliance on autopilot with our compliance solutions.