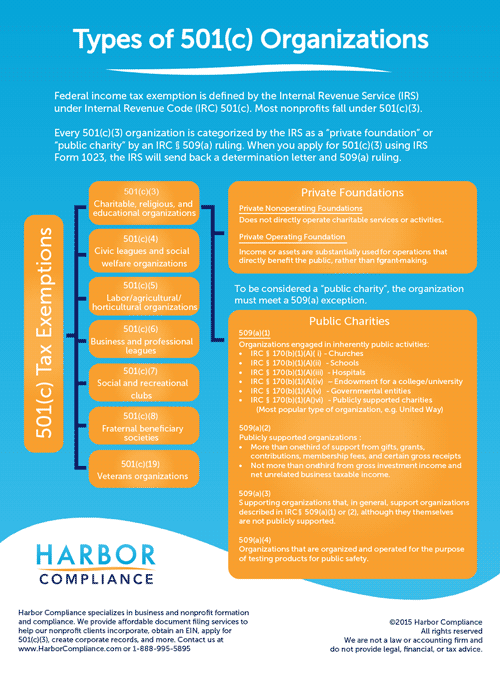

IRS 501(c) Subsection Codes for Tax Exempt Organizations

It is important to identify your desired 501(c) federal tax exemption prior to forming your nonprofit in order to ensure the appropriate language is included in your articles of incorporation or other formation document. If you wait, you will probably incur the delay and expense of amending your formation documents on file with the state.

Nonprofit tax elections and exemptions are defined by the IRS in the Internal Revenue Code

(IRC). State taxation often mirrors the IRS structure.

Most nonprofit corporations are taxed as a C-Corporation until they apply for federal income tax exemption under IRC 501(c).

IRS 501(c) Tax Exempt Options

Below is a description of each 501(c) subsection.

Free Download: Types of 501(c) Organizations

501(c)(3) ...Most popular

“Corporations, and any community chest, fund, or foundation, organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, or educational purposes, or to foster national or international amateur sports competition (but only if no part of its activities involve the provision of athletic facilities or equipment), or for the prevention of cruelty to children or animals, no part of the net earnings of which inures to the benefit of any private shareholder or individual, no substantial part of the activities of which is carrying on propaganda, or otherwise attempting, to influence legislation (except as otherwise provided in subsection (h)), and which does not participate in, or intervene in (including the publishing or distributing of statements), any political campaign on behalf of (or in opposition to) any candidate for public office.”

The IRS further classifies every exempt charitable organization into either a public charity or a private foundation.

- “Public charities are those that (i) are churches, hospitals, qualified medical research organizations affiliated with hospitals, schools, colleges and universities, (ii) have an active program of fundraising and receive contributions from many sources, including the general public, governmental agencies, corporations, private foundations or other public charities, (iii) receive income from the conduct of activities in furtherance of the organization’s exempt purposes, or (iv) actively function in a supporting relationship to one or more existing public charities.” - IRS website

- “Private foundations, in contrast, typically have a single major source of funding (usually gifts from one family or corporation rather than funding from many sources) and most have as their primary activity the making of grants to other charitable organizations and to individuals, rather than the direct operation of charitable programs.” - IRS website

- “Private operating foundations are a hybrid where a private foundation offers direct program services.

501(c)(4)(a)

“Civic leagues or organizations not organized for profit but operated exclusively for the promotion of social welfare, or local associations of employees, the membership of which is limited to the employees of a designated person or persons in a particular municipality, and the net earnings of which are devoted exclusively to charitable, educational, or recreational purposes.”

501(c)(5)

“Labor, agricultural, or horticultural organizations.”

501(c)(6)

“Business leagues, chambers of commerce, real-estate boards, boards of trade, or professional football leagues (whether or not administering a pension fund for football players), not organized for profit and no part of the net earnings of which inures to the benefit of any private shareholder or individual.”

501(c)(7)

“Clubs organized for pleasure, recreation, and other nonprofitable purposes, substantially all of the activities of which are for such purposes and no part of the net earnings of which inures to the benefit of any private shareholder.”

501(c)(8)

“ Fraternal beneficiary societies, orders, or associations— (A) operating under the lodge system or for the exclusive benefit of the members of a fraternity itself operating under the lodge system, and (B) providing for the payment of life, sick, accident, or other benefits to the members of such society, order, or association or their dependents.”

501(c)(10)

“Domestic fraternal societies, orders, or associations, operating under the lodge system— (A) the net earnings of which are devoted exclusively to religious, charitable, scientific, literary, educational, and fraternal purposes, and (B) which do not provide for the payment of life, sick, accident, or other benefits.”

More 501(c) Exemptions

Please refer to IRC 501(c).

Continue reading “What Is Nonprofit Governance?”